The LM curve

|

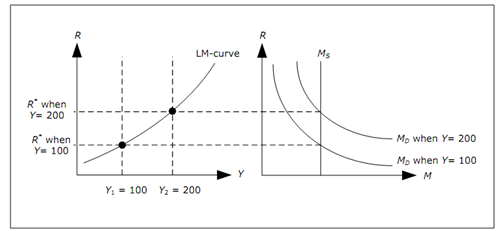

The LM curve shows all combinations of R and Y, where the money market

is in equilibrium. The LM-curve slopes upwards.

|

Money market is in equilibrium when Md(Y, R) = Ms. We know how money market diagram will determine R when we know Y. In this case, question to consider is the following: What should happen to R when we change Y if we want the money market to remain in equilibrium?

To answer this question, we try two different values for GDP Y1 = 100 and Y1 = 200. As the MDrely positively on Y, MD (Y1, R) will be smaller than MD (Y2, R). R should thus be larger when Y increases for the money market to be in equilibrium.

Figure: Derivation of the LM-curve

The figure above explains this point.

1. Start by selecting Y1 and Y2 in the left graph (Y1< Y2).

2. Draw money demand for each of the different levels of GDP in the figure to the right the one corresponding to lower value of GDP should be the smallest.

3. Identify the resulting interest rate in the figure to the right for both levels of GDP - the larger of interest rates corresponds to larger value of GDP.

4. Extend these interest rates to diagram on the left. It will give you two points where money market is in equilibrium.

5. Continue with other levels of GDP. The result would be a curve in the left diagram that we call LM-curve.

LM curve will demonstrate you all combinations of Y and R where Md(Y, R) = Ms, which is, where money market is in equilibrium. Again, economy should be on the LM curve if money market is to be in equilibrium and money market alone can't determine which point will result in equilibrium in all markets.