The usual number of passengers using the service is dependent upon the demand at each particular exchange rate.

At 1·52 Euro/£ expected demand = (0·33·)(500 + 460 + 420) = 460

At 1·54 Euro/£ expected demand = (0·33·) (550 + 520 + 450) = 506·67

At 1·65 Euro/£ expected demand = (0·33·) (600 + 580 +500) = 560

The expected demand is so

= (0·2) (460) + (0.5) (506·67) + (0·3) (560)

= 92 + 253·33 + 168

= 513·3 per train

= 1026·7 per day

(b)

WORKINGS

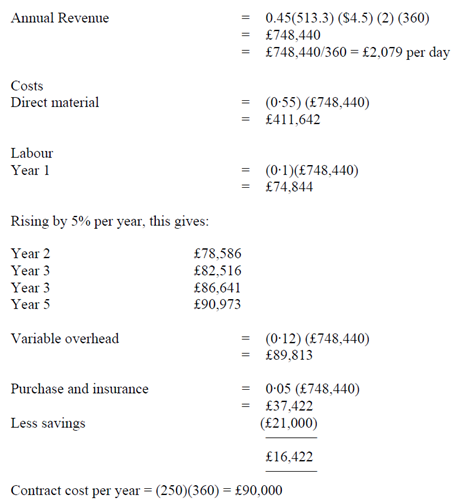

45% of passengers utilize the catering service spending $4.50 per head on average. Two trains are run daily for 360 days per year this give

Gross catering receipts are below an average of £2200 per day so the 5% commission doesn't apply.

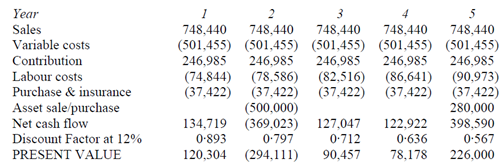

Contribution from the current service

Contribution £246985 per year

Cash Flows: In House Option

NET PRESENT VALUE = £220828

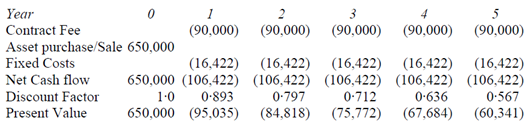

Cash Flows: Contract Out Option

NET PRESENT VALUE = £266350

This option therefore offers an NPV which is £45522 greater than the in-house option which means that profits could be increased by contracting out the catering service.