Reference no: EM13496186

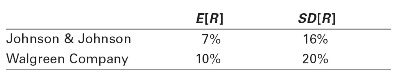

For Problems 1–4, suppose Johnson & Johnson and the Walgreen Company have expected returns and volatilities shown below, with a correlation of 22%.

1.Calculate (a) the expected return and (b) the volatility (standard deviation) of a portfolio that is equally invested in Johnson & Johnson’s and Walgreen’s stock.

2.For the portfolio in Problem 22, if the correlation between Johnson & Johnson’s and Walgreen’s stock were to increase,

a. Would the expected return of the portfolio rise or fall?

b. Would the volatility of the portfolio rise or fall?

3.Calculate (a) the expected return and (b) the volatility (standard deviation) of a portfolio that consists of a long position of $10,000 in Johnson & Johnson and a short position of $2000 in Walgreen’s.

4.Using the same data as for Problem 1, calculate the expected return and the volatility (standard deviation) of a portfolio consisting of Johnson & Johnson’s and Walgreen’s stocks using a wide range of portfolio weights. Plot the expected return as a function of the portfolio volatility. Using your graph, identify the range of Johnson & Johnson’s portfolio weights that yield efficient combinations of the two stocks, rounded to the nearest percentage point.

|

What indirect materials are used to make this product

: Define manufacturing overhead. In addition to the indirect materials and indirect labor previously described, what other manufacturing overhead costs would be incurred in this production process? Be specific and thorough. Make reasonable "guesses"..

|

|

Determine the final temperature inside the cylinder

: An insulated vertical piston cylinder device initialy contains 10kg of water, 6 kg of which is in the vapor phase. Determine the final temperature inside the cylinder

|

|

Analyse the financial data contained

: Critique the usefulness of publicly available financial information contained in the annual report of a company from the perspective of a potential investor.

|

|

Reluctant to participate in focus groups

: Reluctant to participate in focus groups.

|

|

Would the expected return of the portfolio rise or fall

: Calculate (a) the expected return and (b) the volatility (standard deviation) of a portfolio that consists of a long position of $10,000 in Johnson & Johnson and a short position of $2000 in Walgreen’s.

|

|

Find the angular frequency of revolution of the electrons

: In an experiment designed to measure the strength of a uniform magnetic field produced by a set coils, find the angular frequency of revolution of the electrons

|

|

Differentiate between social behavior and culture

: Differentiate between social behavior and culture

|

|

Estimate entries for sale of fixed asset

: Equipment acquired on January 5, 2009, at a cost of $380,000, has an estimated useful life of 16 years, has an estimated residual value of $40,000, and is depreciated by the straight-line method.

|

|

The national association of social workers

: Submit your reaction to this statement of the National Association of Social Workers (NASW). Describe what you think is the role of social workers in equal rights and access to LGBTQ populations.

|