Reference no: EM131152584

Case :-Who's in Charge?

Background

Professor X teaches biology at the University of ND (UND). As part of his employment agreement, UND has the rights to any intellectual property or technology developed by Professor X while he is employed by UND. During his employment at UND, Professor X founded several companies that use the technology he developed. This technology involves the use of non-embryonic (adult) human cells to reprogram genes within adult human cells into stem cells. Each company founded by Professor X is an affiliate of UND (for simplicity, UND) and has entered into an agreement whereby the company would license the technology developed by Professor X from UND in exchange for equity in the company and ongoing royalty payments to UND.

Phoenix

On June 15, 2XX8, Professor X established Phoenix, a biotechnology company that specializes in producing stem cells using the latest technology.

Thunderbird

On January 26, 2XX6, Professor X established Thunderbird, a biotechnology company that specializes in producing stem cells using second-generation technology. Thunderbird is developing products, but has had no revenue (except minimal grant revenue).

Darwin

On November 9, 2XX4, Professor X established Darwin, a biotechnology company that specializes in producing stem cells using first-generation technology. As of mid-2XX8, Darwin has several products and services, contracts with customers, and minimal revenue.

Darwin and Thunderbird share office and lab space, equipment, and employees. Because of ethical concerns and the regulatory environment surrounding embryonic stem-cell research, both Darwin and Thunderbird were unsuccessful in gaining significant market

traction.

The Merger

On July 25, 2XX8, Darwin and Thunderbird merged into Phoenix, the surviving entity. Phoenix issued its common shares to the shareholders of Darwin and Thunderbird in exchange for their shares of Darwin and Thunderbird. After the merger, the Darwin and

Thunderbird legal entities ceased to exist. The shareholders of Phoenix, Darwin, and Thunderbird agreed that the value of each of the respective companies was equal.

The initial financing for each of the three companies was provided by a venture investor, VC, in exchange for equity in each of the companies. VC is an investment company that accounts for its investments at fair value in accordance with the specialized accounting

guidance in ASC 946. VC proposed the merger to Professor X, who gave preliminary support for exploration of the proposal. The proposal was then discussed with the boards of each of the companies. The reasons for the merger include

(1) the opportunity for all parties to participate in the benefits of Phoenix's technology and

(2) the potential benefits of shared management, economies of scale, scientific cross-fertilization, and enhanced fundraising capacity. In addition, Phoenix was able to acquire access to Darwin's and Thunderbird's employees, their stem-cell scientific know-how, equipment, and facilities.

Ownership, Governance, and Significant Financial Information

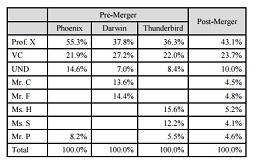

Before the merger, there was some common ownership among Phoenix, Darwin, and Thunderbird. Professor X controlled Phoenix, but no one shareholder controlled Darwin or Thunderbird. In addition, each of the companies had individual investors. The following table illustrates the shareholder ownership of the entities pre-merger and post merger:

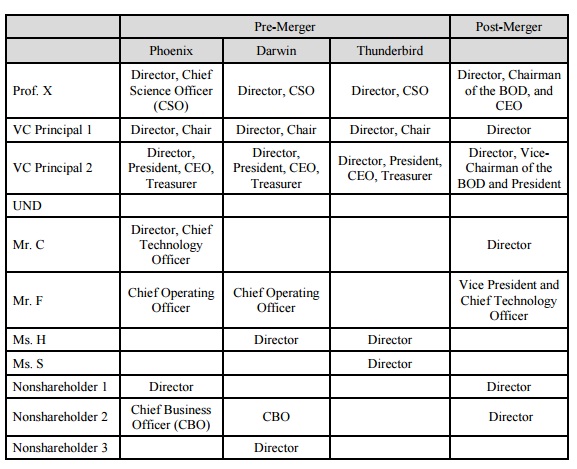

As noted above, Darwin, Thunderbird, and Phoenix had common investors and thus, had many common members of their boards of directors and some common members of senior management. Each director had a single vote, and there was no agreement among

the directors that required board members to vote together. Certain significant decisions at each company, such as a change in control, merger, or change in capital structure (i.e., protective rights), required at least a 75 percent voting share approval. To effect the

merger agreement, 75 percent of Darwin's voting shareholders, 80 percent of Thunderbird's voting shareholders, and 75 percent of Phoenix's voting shareholders were required to approve the transaction.

The following table illustrates the governance roles of the shareholders in the entities premerger and post-merger:

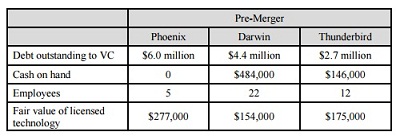

The following table provides key financial information before the transaction:

At the time of the merger, each company was deemed to be of equal of value, $5.3 million. However, no valuation assessment was performed to independently verify that. The majority of the value of each of the companies was related to the employees, scientific know-how, and technology. Phoenix's technology is estimated to have the highest fair value of $277,000.

In this case study, assume that VC meets the definition of an investment company under both U.S. GAAP and IFRSs.

Required:

1. How should Phoenix account for its acquisition of 100 percent of equity interests in Darwin and Thunderbird: as a merger of entities under common control or as a business combination?

2. If the merger of Phoenix, Darwin, and Thunderbird is a business combination, which entity should be identified as the accounting acquirer?