Reference no: EM131419085

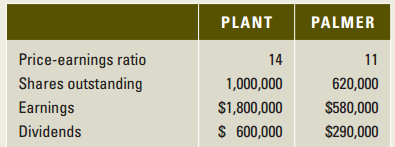

Calculating NPV Plant, Inc., is considering making an offer to purchase Palmer Corp. Plant's vice president of finance has collected the following information:

Plant also knows that securities analysts expect the earnings and dividends of Palmer to grow at a constant rate of 5 percent each year. Plant management believes that the acquisition of Palmer will provide the firm with some economies of scale that will increase this growth rate to 7 percent per year.

a. What is the value of Palmer to Plant?

b. What would Plant's gain be from this acquisition?

c. If Plant were to offer $17 in cash for each share of Palmer, what would the NPV of the acquisition be? d. What's the most Plant should be willing to pay in cash per share for the stock of Palmer?

e. If Plant were to offer 250,000 of its shares in exchange for the outstanding stock of Palmer, what would the NPV be?

f. Should the acquisition be attempted, and, if so, should it be as in (c) or as in (e)?

g. Plant's outside financial consultants think that the 7 percent growth rate is too optimistic and a 6 percent rate is more realistic. How does this change your previous answers?

|

Describe the sample in given problem

: Is this an observational or an experimental study?- Describe the sample in this problem.- Is this a random sample? Justify your answer.

|

|

Explain policies you wished regarding tobacco

: We have made a policy decision that tobacco is a legal substance. If you were in the position to enact whatever policy or policies you wished regarding tobacco what would they be and why?

|

|

Employee male co-worker

: Formulate the conversation you would have with the employee, based the concepts found in Chapter 2 in your textbook. Summarize the conversation you would have with the employee's male co-worker, based on the concepts found in Chapter 2 of your textb..

|

|

Describe the expected findings of a proposed research study

: Apply knowledge of research methodology to design an ethically appropriate plan for a psychological research study.Evaluate a body of literature, providing context for a proposed research study.Develop research methodology for a proposed research stu..

|

|

What would plant’s gain be from this acquisition

: What would Plant's gain be from this acquisition?

|

|

Is given a random sample

: The contents of each selected bottle are carefully measured.- Describe the population and the sample in this problem.- Is this a random sample? Justify your answer.

|

|

What characteristics make an organization attractive

: What characteristics make an organization attractive to you? List some specific companies that you think have those characteristics. What factors have influenced your perceptions about these companies? What features increase the attractiveness of com..

|

|

Assignment-performance management methods

: Performance management includes activities which ensure that goals are consistently being met in an effective and efficient manner. Performance management can focus on the performance of an organization, a department, employee, or even the process..

|

|

Essay about on coming to the community college

: Essay about on coming to the community college. This should be written in third person point of view. There must be in text citations and a Works Cited page in MLA documentation.

|