Reference no: EM131468386

1. The role of the manager is to:

A. Maximise firm profits

B. Minimise risk

C. Optimise the time pattern of consumption of the shareholders

D. Maximise shareholder value

2. Of the following list, which is a stakeholder?

I) Employee; II) Customer; III) Community; IV) Supplier

A. I, II and IV only

B. III only

C. I and II only

D. All

4. The following are important functions of financial markets:

I) Source of financing; II) Provide liquidity; III) Reduce risk; IV) Source of information

A. I only

B. I and II only

C. I, II, III, and IV

D. IV only

5. Mr. Johnson has R500 income this year and zero income next year. The market interest rate is 14% per year. If Mr. Johnson consumes R200 this year, and invests the rest in the market, what will be his potential consumption (if he consumes as much as possible) next year?

A. R300

B. R263

C. R342

D. R228

6. Mr. Hewlett has R1000 income this year and R1200 income next year. The market interest rate is 8% per year. Mr. Dell also has an investment opportunity in which he can invest R500 this year and receive R550 next year. Suppose Mr. Dell consumes R500 this year and invests in the project. What is the NPV of the investment opportunity?

A. -R9.30

B. R9.26

C. R0

D. 2%-

7. If the present value of R560 to be paid at the end of one year is R500, what is the one-year discount factor?

A. 1.12

B. 1.36

C. 0.88

D. None of the above

8. At an interest rate of 10%, which of the following cash flows should you prefer? (assuming they cost the same)

|

|

Year 1

|

Year 2

|

Year 3

|

|

A)

|

500

|

300

|

100

|

|

B)

|

100

|

300

|

500

|

|

C)

|

300

|

300

|

300

|

|

D)

|

Any of the above as they all add up to $900

|

A. Option A

B. Option B

C. Option C

D. Option D

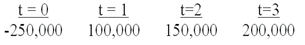

9. What is the net present value (NPV) of the following cash flows at a discount rate of 9%?

A. R122,431.81

B. R200,000

C. R155,950.68

D. None of the above

10. The opportunity cost of capital for a risky project is

A. The expected rate of return on a government security having the same maturity as the project

B. The expected rate of return on a well-diversified portfolio of common stocks

C. The expected rate of return on a portfolio of securities of similar risks as the project

D. None of the above

11. If the three-year present value annuity factor is 2.673 and two-year present value annuity factor is 1.833, what is the present value of R1 received at the end of the 3 years?

A. R1.1905

B. R0.84

C. R0.89

D. None of the above

12. If the five-year present value annuity factor is 3.60478 and four-year present value annuity factor is 3.03735, what is the present value at the R1 received at the end of five years?

A. R0.63552

B. R1.76233

C. R0.56743

D. None of the above

13. For R10,000 you can purchase a 5-year annuity that will pay R2504.57 per year for five years. The payments are made at the end of each year. Calculate the effective annual interest rate implied by this arrangement: (approximately)

A. 8%

B. 9%

C. 10%

D. None of the above

14. If the present value of R1.00 received n years from today at an interest rate of r is 0.3855, then what is the future value of R1.00 invested today at an interest rate of r% for n years?

A. R1.3855

B. R2.594

C. R1.70

D. Not enough information to solve the problem

15. John House has taken a 20-year, R250,000 mortgage on his house at an interest rate of 6% per year. What is the value of the mortgage after the payment of the fifth annual installment?

A. R128,958.41

B. R211,689.53

C. R141,019.50

D. None of the above

16. A government bond issued in JHB has a coupon rate of 5%, face value of R1000 and maturing in five years. The interest payments are made annually. Calculate the price of the bond if the yield to maturity is 3.5%.

A. R1000

B. R1067.70

C. R1063.30

D. none of the above

17. A government bond issued in South Africa has a coupon rate of 5%, face value of R100 and maturing in five years. The interest payments are made annually. Calculate the yield to maturity of the bond if the price of the bond is R106.

A. 5.00%

B. 3.80%

C. 3.66%

D. none of the above

18. Consider a bond with a face value of $1,000, a coupon rate of 6%, a yield to maturity of 8%, and five years to maturity. This bond's duration is:

A. 4.7 years

B. 4.4 years

C. 4.1 years

D. 5 years