Reference no: EM13488452

Pricing & possible plant closure

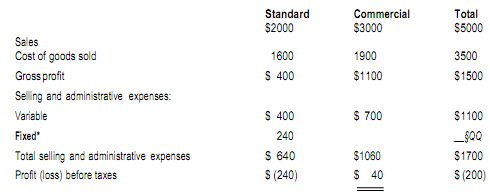

Handy Household Products Ltd is a multiproduct company with several manufacturing plants. The Fremantle plant manufactures and distributes two household cleaning and polishing compounds, standard and commercial, under the Clean & Bright label. The forecast operating results for the first six months of the current year, when 100000 boxes of each compound are expected to be manufactured and sold, are presented in the following statement:

*The fixed selling and administrative expenses are allocated between the two products on the basis of dollar sales volume.

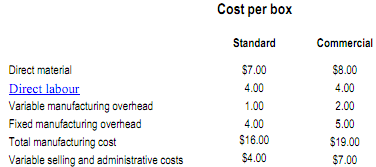

The standard compound sold for $20 a box and the commercial compound sold for $30 a box during the first six months of the year. The manufacturing costs are presented in the schedule below. Each product is manufactured on a separate production line. Annual normal manufacturing capacity is 200 000 boxes of each product. However. the plant is capable of producing 250 000 boxes of standard compound and 350000 boxes of commercial compound annually.

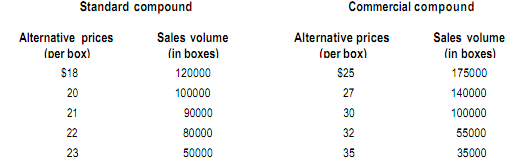

The following schedule reflects the consensus of top management regarding the price-volume alternatives for the Clean & Bright products for the last six months of the current year. These are essentially the same alternatives management had during the first six months of the year.

Handy Household Products' top management believe that the loss for the first six months reflects a tight profit margin caused by intense competition. Management also believe that many companies will leave this market by next year and profit should improve.

Required:

1. What unit selling price should management select for each of the Clean & Bright compounds for the remaining six months of the year to maximise profit? Support your selection with appropriate calculations.

2. Independently of your answer to requirement 1, assume that the optimum alternatives for the last six months were as follows: a selling price of $23 and volume of 50 000 boxes for the standard compound, and a selling price of $35 and volume of 35 000 boxes for the commercial compound.

(a) Should management consider closing down the plant's operations until January 1 of the next year in order to minimise its losses? Support your answer with appropriate calculations.

(b) Identify and discuss the strategic factors that should be considered in deciding whether the Fremantle plant should be closed down during the last six months of the current year.

Question 3: Budgeting

Hawthorn Leisure Works (HLW) offers tennis courts and other physical fitness facilities to its members. The club has 2000 members. Revenue is derived from annual membership fees and hourly court fees. The annual membership fees are:

Individual $45

Student 30

Family 100

Approximately half the members are 'family', and the remaining memberships are split equally between individuals and students. For the next two financial years, the hourly court fees are $8 and $12, depending on the season and the time of day (prime versus non-prime time). There are 10 courts at each club. The courts are available for 12 hours per day, from 9 am to 9 pm.

The peak tennis season runs from October to April (181 days). During this period, court usage averages from 90 to 100 per cent of capacity during prime time (5 to 9 pm) and from 50 to 60 per cent of capacity during the remaining hours (9 am to 4 pm). Daily court usage during the off-season averages from only 20 to 40 per cent of capacity, and is charged at $6 per hour. All of HLW's memberships expire at the end of September. A substantial amount of the cash receipts is collected during the early part of the tennis season due to the renewal of annual membership fees and heavy court usage. However, cash receipts are not as large in autumn and drop significantly in the winter months.

For the start of the new financial year on 1 October, HLW is considering introducing a new membership and fee structure in an attempt to improve its cash flow planning. Under the new membership plan, only an annual membership fee would be charged, rather than a membership fee plus hourly court fees. There would be two classes of membership, with annual fees as follows:

Individual $300

Family 500

The annual fee would be collected in advance at the time the membership application was completed. Members would be allowed to use the tennis courts as often as they wished during the year under the new plan. All future memberships would be sold under these new terms. A special promotional campaign would be instituted to attract new members and to encourage current members to remain with the club. The annual fees for individual and family memberships would be reduced to $250 and $450 respectively if members pay for their yearly memberships in advance during the two-month promotional campaign.

Hawthorn Leisure Works' management estimates that 70 per cent of the current members will continue with the club, and student members would convert to individual membership. The most active members (45 per cent of the current members) would pay the yearly fee in advance and receive the special fee reduction, while the remaining members who continued would renew memberships in October. Those members who would not rejoin are not considered active (that is, they play five times or less during the year). Management estimates that the loss of members would be offset fully by new members within six months of instituting the new plan. These new members would pay a proportional amount of the yearly fee on joining. Furthermore, many of the new members would be individuals who would play during non-prime time. Management estimates that adequate court time will be available for all members under the new plan.

If the new membership plan is adopted, it would be instituted at the start of the new financial year (1 October), which is the start of the tennis season. The special promotional campaign would be conducted during August and September, prior to the start of the new financial year.

Required:

Your consulting firm has been hired to help HLW to evaluate its new fee structure. Write a letter to the club's managing director dealing with the following issues:

1 Will HLW's new membership plan and fee structure improve its ability to plan its cash receipts? Explain your answer.

2 Estimate the effect on sales revenue resulting from the planned change in fee structure for the next financial year, which starts 1 October and ends on 30 September. State any assumptions that you need to make.

3 Hawthorn Leisure Works should evaluate the new membership plan and fee structure completely before it decides to adopt or reject it.

(a) Identify the key factors that HLW should consider in its evaluation.

(b) Explain what type of financial analyses HLW should prepare in order to make a complete evaluation.

4 Explain how HLW's cash management practices may differ from the present if the new membership plan and fee structure are adopted.