Reference no: EM131368384

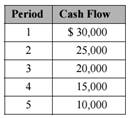

Given the following set of cash flows:

a. If your required rate of return is 8% per year, what is the present value of the above cash flows? Future value?

b. Now, suppose that you are offered another investment that is identical, except that the cash flows are reversed (i.e., cash flow 1 is 10,000, cash flow 2 is 15,000, etc). Is this worth more, or less, than the original investment? Why?

c. If you paid $75,000 for the original investment, what average annual rate of return would you earn? What return would you earn on the reversed cash flows?

d. Still assuming that your required return is 8%, would you be willing to purchase either of these investments? Explain why, or why not.

|

Similarities between public relations and propaganda

: Write the given essay assignment.- Explain the similarities and differences between public relations and propaganda.

|

|

How various organizational structures impact project process

: PROVISION Healthcare Technologies manufactures patient image wands (hardware with underlying software) used by healthcare providers (primarily hospitals and physician offices) as part of larger systems to test and monitor patients' body functions...

|

|

How much would you accumulate in each of the above funds

: What relationship do you notice between the frequency of investment and the future value? Create a Column chart of the results that more clearly shows the outcome from more frequently investing

|

|

Write a c program using the fork system

: Write a C program using the fork () system call that generates this sequence in the child process. The starling number will be provided from the command line

|

|

What return would you earn on the reversed cash flows

: Now, suppose that you are offered another investment that is identical, except that the cash flows are reversed (i.e., cash flow 1 is 10,000, cash flow 2 is 15,000, etc). Is this worth more, or less, than the original investment? Why?

|

|

What challenges did you face

: What challenges did you face? What have you learned from the experience?- What would you or will you change?

|

|

Select four examples of visual culture

: Select four individual examples of visual culture studied since mid-term and discuss how they devalue and/or objectify women and/or those individuals who do not conform to a binary construction of gender.

|

|

Explain the purpose of a disaster recovery plan

: The purpose of this assignment is for you to think critically about disaster recovery planning for cloud computing and why such a plan is important to a business. Compose a two-page paper that addresses each of the following:

|

|

How much would you receive each year

: The cash prize is the present value of the annuity payments. If interest rates are 7.5%, how much will you receive if you choose the cash option?

|