Reference no: EM13212285

1. Pollos Inc. wants to raise $2 million by issuing ten-year zero coupon bonds with a face value of $1,000. Its investment banker states that investors would use a 9.2% discount rate to value such bonds.

a. At what price would these bonds sell in the market-place?

b. How many bonds would the firm have to issue to raise $2 million?

c. In ten years, how much will Pollos Inc. have to pay back to bond holders?

Assume semiannual compounding. (note: a company cannot issue a portion of a bond so when calculating the number of bonds needing to be sold, don't forget to round up)

2. SCDP Corp. is planning to issue 10-year bonds. The going market yield for such bonds is 9%. Assume that coupon payments will be made semiannually. The firm is trying to decide between issuing an 10% coupon bond or a zero coupon bond. The company needs to raise $1 million.

a. What will be the price of an 10% coupon bond?

b. How many 10% coupon bonds would have to be issued?

c. What will be the price of a zero coupon bond?

d. How many zero coupon bonds will have to be issued?

3. Swearengen Inc. will pay dividends of $6.00, $7.50, $5.50, and $4.00 in the next four years. Thereafter, the company expects its dividend growth rate to be constant at 8%. If the required rate of return is 17%, what is the current value of the stock?

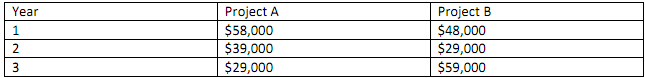

4. Bueller Bicycle Inc. is considering two investments, both of which cost $100,000. The cash flows are as follows.

a. Which of the two projects should be chosen based on the payback method (show calculations for each)

b. Assuming a 10% cost of capital, which of the two projects should be chosen based on the net present value method (Which project has the higher NPV)?

c. Should a firm normally have more confidence in answer a or answer b?

Attachment:- Farida.xlsx