Reference no: EM131942208

Energy Planning and Policy Program Assignment: Evaluation of Infrastructure Investments

PART A: EVALUATION OF INVESTMENT PROPOSALS

This part of the assignment is about the evaluation of two project proposals. The main objective of this analysis is to ascertain the financial and socio-economic viabilities of the two proposals. The capital cost of each of these proposals is $10billion (bn). Other details are provided below.

Proposal A

Proposal A envisages generation of electricity from water - a hydro-electric project. The useful economic life of this project is estimated to be 50 years. This project will generate 20,000 million (mn) units of electricity annually. Electricity will be sold to the public at a tariff of 10 cents per unit for the first twenty years, and 7.8 cents thereafter. The annual operation and maintenance costs will be 10 percent of the capital cost for the first twenty years and 5 percent thereafter.

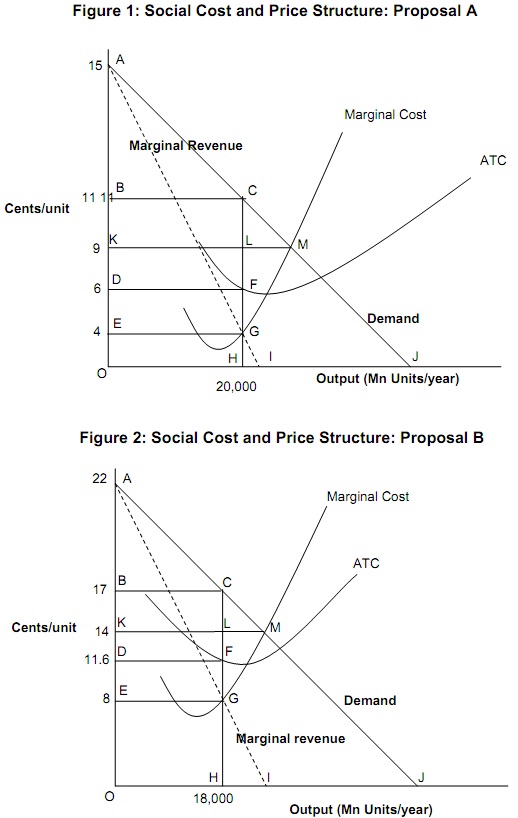

The socio-economic costs and benefits for this project can be estimated from Figure 1.

Proposal B

Proposal B is a thermal project - electricity will be generated from coal. The annual operation and maintenance cost for this project will be 25 percent of its capital cost. This project will have a useful economic life of 25 years. It will generate 18,000mn units of electricity annually. Electricity from this project will be sold at 20 cents per unit. At the end of its useful life, this project can be sold for 2 percent of its capital cost.

The socio-economic costs and benefits for this project can be estimated from Figure 2.

Task

Your task is simply to summarize the results of your analysis in the answer-sheet provided separately.

Notes:

• You must provide the background details (i.e., select calculations), for various answers provided by you in the answer-sheet, in an Annexure (no more than two pages). The minimum permissible font size for the Annexure is 12 (Times Roman or equivalent).

• The completed answer-sheet must however be a stand-alone document (i.e., the reader should be able to understand the entire logic behind your reasoning without needing to refer to the Annexure.

Assumptions (common to both proposals)

• All capital costs are incurred at time t=0 (i.e., ignore project construction time).

• Social costs and benefits (Figures 1 and 2):

- costs and benefits are all inclusive, i.e., costs include capital as well as operation and maintenance costs, and benefits include revenue and salvage value;

- costs and benefits remain unchanged throughout the useful economic lives of the two projects; and

- electricity market is a ‘monopoly' market.

• The ‘Apparent' discount rate for hydro projects is 13.3 percent. The ‘Real' discount rate for thermal project is 10. Inflation - applicable for both projects - is expected to be 3 percent over the project life. Coal price is likely to escalate by 2 percent.

Figure 1: Social Cost and Price Structure: Proposal A and Figure 2: Social Cost and Price Structure: Proposal B.

PART B: RATE OF RETURN

Private electricity utilities often argue that public electricity utilities earn the same rate of return as their private sector counterparts and that the returns for public utilities be computed on the basis of the private sector's cost of capital.

a) Provide possible reasoning behind this argument (no more than three lines).

b) Do you agree with this reasoning? (Yes or No)

c) Why? (no more than three lines)

PART C: OPPORTUNITY COST

Provide a philosophical critique of the concept of ‘Opportunity Cost' as a means to determine economic costs while evaluating large electricity infrastructure projects (no more than two dot points with each dot point no more than two lines).

PART D: APPROPRIATENESS OF ‘NPV'

Review the following articles:

Berkovitch, Elazar and Israel, Ronen (2004) Why NPV Criterion does not Maximize NPV, The Review of Financial Studies, Spring 2007, Vol.17, No.1, pp. 239-255.

Ross, Stephen A. (1995) Uses, Abuses, and Alternatives to the Net-Present-Value Rule, Financial management, Vol. 24, No. 3, Autumn 1995, pp. 96-102.

Based on your review, please answer the following questions:

a) What is the ‘common theme' that is discussed in each of these articles? (No more than two lines.)

b) What is the overriding perspective offered by each of these articles in relation to the common themes noted above? (No more than two lines for each article.)

c) Do you agree with this perspective? (Yes or No - on word only, for each article.) Provide reasoning in support of your answer. (No more than two lines for each article.)

PART E: ‘INTEREST'

In some cultures, charging of ‘interest' (and its precursor ‘usury') was historically considered undesirable. In some cultures, it still is? The use of interest rate is however commonplace in modern public discourse?

Why was/is charging of ‘interest' viewed negatively by some cultures? (no more than three lines).

What developments may have contributed to the transformation of the viewpoints on ‘interest' - from being undesirable, to being desirable, to being indeed imperative? (no more than two ‘dot' points, with each dot point no more than two lines).