Reference no: EM131144994

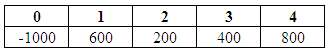

Use the following cash flows for the next 6 questions. (All answers should show up to 2 decimal points.)

1. What is the NPV? (Use 10% as a discount rate and calculator)

2. Compute the PI (Profitability index). (Use 10% as a discount rate and calculator)

3. Compute IRR (Use calculator)

4. Using the following certainty equivalent coefficients (CECs) and risk-free interest rate 6%, compute the certainty equivalent NPV (E(NPV)):

CEC1 = 0.8, CEC2 = 0.8, CEC3 = 0.6, and CEC4 = 0.6.

5. Currently, the risk-free interest rate is 6% and the expected rate of return on the market portfolio is 14 percent. Assuming that beta of the project generating the above cash flows is 2, compute the expected NPV. (Use the RAD method).

6. Assuming the cost of capital is 16 percent compute the annualized net present value (the equivalent annualbenefit).

|

Prepare a schedule computing the net cash flow from operatin

: Prepare a schedule computing the net cash flow from operating activities that would be shown on a statement of cash flows-(b) using the direct method.

|

|

Perfect substitutes-indifference curves

: Sarah Jones believes that Coke and Pepsi are perfect substitutes. That is, she is equally happy with a Coke or a Pepsi and cannot tell the difference between them. Her indifference curves:

|

|

Cash spent on plant asset additions during the year

: Canwest Global Communications Corp. reported cash used by operating activities of $104,539,000 and revenues of $2,867,459,000 during 2009.

|

|

Colburn corporation reported cash provided by operating

: Colburn Corporation reported cash provided by operating activities of $412,000, cash used by investing activities of $250,000, and cash provided by financing activities of $70,000. In addition, cash spent for capital assets during the period was $200..

|

|

What is the npv and compute the profitability index

: Use the following cash flows for the next 6 questions. (All answers should show up to 2 decimal points.) What is the NPV? (Use 10% as a discount rate and calculator) Compute the PI (Profitability index). (Use 10% as a discount rate and calculator) C..

|

|

Donating the property razing the property

: Common methods for facilities managers to dispose of properties include: Donating the property Razing the property and rebuilding on the site Subdividing the property A tax free exchange for another property All of the above

|

|

Evaluate market forces-current trends and changes

: Current Trends and Issues in Managed Care Using the South University Online library or the Internet, research on a series of topics that will help you understand the current issues regarding managed care. Pharmacy benefit management. Describe and eva..

|

|

Cypress semiconductor corporation reported cash provided

: During 2009, Cypress Semiconductor Corporation reported cash provided by operations of $89,303,000, cash used in investing of $43,126,000, and cash used in financing of $7,368,000.

|

|

People-task centered strategies for minimizing resistance

: Why is change often perceived as a win/lose proposition between leaders and followers? What is the difference between people and task centered strategies for minimizing resistance to change?

|