Reference no: EM131101192

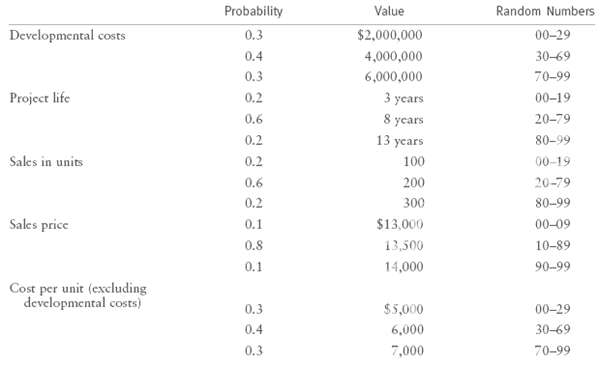

Singleton Supplies Corporation (SSC) manufactures medical products for hospitals, clinics, and nursing homes. SSC may introduce a new type of X-ray scanner designed to identify certain types of cancers in their early stages. There are a number of uncertainties about the proposed project, but the following data are believed to be reasonably accurate.

�

SSC uses a cost of capital of 15 percent to analyze average-risk projects, 12 percent for low-risk projects, and 18 percent for high-risk projects. These risk adjustments reflect primarily the uncertainty about each project's NPV and IRR as measured by the coefficients of variation of NPV and IRR. SSC is in the 40 percent federal plus-state income tax bracket.

a. What is the expected IRR for the X-ray scanner project? Base your answer on the expected values of the variables. Also, assume the after-tax "profits" figure you develop is equal to annual cash flows. All facilities are leased, so depreciation may be disregarded. Can you determine the value of _IRR short of actual simulation or a fairly complex statistical analysis?

b. Assume that SSC uses a 15 percent cost of capital for this project. What is the project's NPV? Could you estimate _NPV without either simulation or a complex statistical analysis?

c. Show the process by which a computer would perform a simulation analysis for this project. Use the random numbers 44, 17, 16, 58, 1; 79, 83, 86; and 19, 62, 6 to illustrate the process with the first computer run. Actually calculate the first-run NPV and IRR. Assume that the cash flows for each year are independent of cash flows for other years. Also, assume that the computer operates as follows:

(1) A developmental cost and a project life are estimated for the first run using the first two random numbers.

(2) Next, sales volume, sales price, and cost per unit are estimated using the next three random numbers and used to derive a cash flow for the first year.

(3) Then, the next three random numbers are used to estimate sales volume, sales price, and cost per unit for the second year, hence the cash flow for the second year.

(4) Cash flows for other years are developed similarly, on out to the first run's estimated life.

(5) With the developmental cost and the cash flow stream established, NPV and IRR for the first run are derived and stored in the computer's memory.

(6) The process is repeated to generate perhaps 500 other NPVs and IRRs.

(7) Frequency distributions for NPV and IRR are plotted by the computer, and the distributions' means and standard deviations are calculated.

|

What is the project''s payback period

: a. What is the project's payback period (to the closest year)? b. What is the project's discounted payback period? c. What is the project's NPV? d. What is the project's IRR? e. What is the project's MIRR?

|

|

Would this project be of high low average stand-alone risk

: Find the project's standard deviation of NPV and coefficient of variation (CV) of NPV. If YYC's average project had a CV of between 1.0 and 2.0, would this project be of high, low, or average stand-alone risk?

|

|

Explain how net operating working capital

: Explain how net operating working capital is recovered at the end of a project's life, and why it is included in a capital budgeting analysis.

|

|

What is the value of the stock today

: After Year 5, the company should grow at a constant rate of 8 percent per year. If the required return on the stock is 15 percent, what is the value of the stock today?

|

|

What is the expected irr for the x-ray scanner project

: What is the expected IRR for the X-ray scanner project? Base your answer on the expected values of the variables. Also, assume the after-tax "profits" figure you develop is equal to annual cash flows. All facilities are leased, so depreciation may be..

|

|

What is the expected value of the annual net cash flow

: BPC has decided to evaluate the riskier project at a 12 percent rate and the less risky project at a 10 percent rate. a. What is the expected value of the annual net cash flows from each project? What is the coefficient of variation (CV)? (Hint: =B ..

|

|

What is the project’s expected npv

: Shao Industries is considering a proposed project for its capital budget. The company estimates that the project's NPV is $12 million. This estimate assumes that the economy and market conditions will be average over the next few years. What is the p..

|

|

Should the firm accept the project if total costs consisted

: Should the firm accept the project? (Hint: The project is perpetuity so you must use the formula for perpetuity to find its NPV.) If total costs consisted of a fixed cost of $10,000 per year and variable costs of $95 per unit, and if only the variabl..

|

|

Should the spectrometer be purchased

: The spectrometer would have no effect on revenues, but it is expected to save the firm $25,000 per year in before tax operating cost, mainly labor. The firm's marginal federal-plus-state tax rate is 40%. If the project's cost of capital is 10%, shoul..

|