Reference no: EM131018058

Practice Questions #5

Goal:

- Learn firm's behavior if the market were a monopoly, monopolistic competition or oligopoly.

- Compare the equilibrium prices and outputs in different kinds of market structures, both in the short run and in the long run.

1. Let the demand curve in some market be given by:

Market Demand: P = 12 - 2Q

Suppose presently there are 100 competitive firms in the market and they are identical (that is, they have the same cost function). The marginal cost function of a representative firm is:

MC = 200Q

Market supply curve is found by horizontally summing the individual MC curves and hence is

Market Supply: P = 2Q

Answer the following questions.

a. What would be the equilibrium price and quantity if the market were purely competitive?

b. Suppose that a single company buys all 100 firms and becomes a monopoly in this market. The technology does not change but only does the ownership. The marginal revenue is MR = 12 - 4Q (See if you can get this function from the TR function).

What is the profit-maximizing output and price for the single-price monopoly?

c. Draw the demand, MR and MC curves. Mark the equilibrium price and quantity for the purely competitive market, and the profit-maximizing output and price for a single- price monopoly. What is your conclusion from this comparison?

d. You can imagine that there is a welfare loss due to the monopolization. Compute the deadweight loss.

2.

P Q TR MR TC ATC MC

20 0 3

18 1 4

16 2 6

14 3 10

12 4 16

10 5 26

The above table shows the market demand schedule and the cost structure.

a. Fill in all the columns for TR, MR, ATC and MC.

b. If the market were a single-price monopoly, what would be the profit-maximizing output and price? How much would be the economic profit?

c. If the market were purely competitive, what would be the equilibrium price and output?

d. If the market were a monopoly and it practiced perfect price discrimination. What would be the highest and the lowest prices it can charge?

e. Suppose the same situation as in d. but the monopoly can only sell the goods one by one unit (for instance, you cannot sell a car in half). How much would be the total economic profit? How much extra profit it can earn by perfect price discrimination than by a single price?

3. Toyota and Ford are considering introducing a new model of truck into the car market. Each presently earns $20 million. If Toyota does bring its new model into the market and Ford does not, Toyota's profits will be $25 million and Ford's profits will be $15 million. If Ford decides to introduce its new model and Toyota does not, Toyota's profits will be $16 million and Ford's profits will be $22 million. If they both decide to introduce, each earns $18 million in profits. If neither of them wants to introduce, each earns the present profits.

a. Construct the payoff matrix for the two companies.

b. Are there any dominant strategies for each company? If yes, what are they?

c. What is the equilibrium outcome in this game?

d. Suppose the two companies play the game many times, and to simplify, we assume the game in each period is the same as the first one. In the long run, can you predict what the equilibrium outcome will be?

4. The following table is the demand schedule. We assume the marginal cost is 0 at any level of output.

| Q |

P |

|

4

|

24

|

|

5

|

21

|

|

6

|

18

|

|

7

|

15

|

|

8

|

12

|

| 9 |

9 |

a. If the market were a single-price monopoly, what would be the profit-maximizing price and output?

From now on, suppose there are two firms in the market and still their marginal cost is 0. Denote the output of Firm 1 as q1 and the output of Firm 2 as q2. It is illegal to collude.

b. When q1 = 3 and q2 = 3, how much is the economic profit each firm can earn?

c. When q1 = 3 and q2 = 4, how much is the economic profit each firm can earn?

d. When q1 = 4 and q2 = 4, how much is the economic profit each firm can earn?

e. Are there any dominant strategies for each firm according to what you got in b. to d.? What is the equilibrium outcome in this duopoly market?

f. Considering the price and output COLLECTIVELY in the duopoly market, what can you conclude by the comparison with the monopoly outcome?

5. The following table illustrates the LRATC for a representative firm in different market structures: pure competition, natural monopoly and natural oligopoly. Suppose the demand is the same in all market structures and we know the quantity demanded would be 10,000 if price were $10.

LRATC

|

Q

|

A

|

B

|

C

|

|

500

|

20

|

20

|

10

|

|

2,500

|

16

|

12

|

12

|

|

5,000

|

14

|

10

|

14

|

|

7,500

|

12

|

12

|

16

|

|

10,000

|

10

|

15

|

18

|

|

12,500

|

8.5

|

18

|

20

|

a. What is the MES (minimum efficient scale) in market structure A, B and C, respectively?

b. What is the maximum number of firms possibly in each market structure?

c. Identify the respective market structure represented by column A, B, C. Explain your reason.

d. Explain in each market structure, how the shape of LRATC curve affects the incumbent firm's profits and the behavior of potential entrants (entering into the market or not).

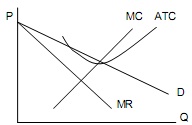

6. This problem purports to capture the difference between three kinds of market structures: monopoly (M), pure competition (PC), and monopolistic competition (MC). The below figure shows the market demand and the cost structure. Suppose presently the market is in long-run equilibrium. Denote the long-run equilibrium price under (PC) as PPC, and output as QPC. Also denote the profit-maximizing prices and outputs under (M) and (MC) as PM, QM, PMC and QMC respectively.

a. Compare the long run price, PM, PMC, PPC. Also compare the economic profits in the long run.

b. Discuss the reasons that make PM, PMC, PPC different.

c. You may notice that QM > QPC > QMC in the long run. Provide your explanation related to firms' capacity outputs.