Reference no: EM13487342

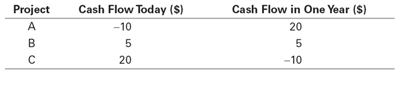

1.Your firm has identified three potential investment projects. The projects and their cash flows are shown here:

Suppose all cash flows are certain and the risk-free interest rate is 10%.

a. What is the NPV of each project?

b. If the firm can choose only one of these projects, which should it choose?

c. If the firm can choose any two of these projects, which should it choose?

2.Your computer manufacturing firm must purchase 10,000 keyboards from a supplier. One supplier demands a payment of $100,000 today plus $10 per keyboard payable in one year. Another supplier will charge $21 per keyboard, also payable in one year. The risk-free interest rate is 6%.

a. What is the difference in their offers in terms of dollars today? Which offer should your firm take?

b. Suppose your firm does not want to spend cash today. How can it take the first offer and not spend $100,000 of its own cash today?

|

What kind of pension plan does p&g provide

: What kind of pension plan does P&G provide its employees in the United States and what was P&G's pension expense for 2009, 2008, and 2007 for the United States?

|

|

Determine the rockets thrust

: A rocket, which is in deep space and initially at rest relative to an inertial reference frame, has a mass of 84.1 x 105 kg, of which 6.63 x 105 kg is fuel. What is the rocket's thrust

|

|

What is the capacitance of the membrane

: A cell membrane acts as a parallel-plate capacitor with a spacing of 13 nm and filled with water. Suppose the positive plate is on top, What is the capacitance of the membrane

|

|

Find the angle of the first-order diffraction

: X rays diffract from a crystal in which the spacing between atomic planes is 0.193nm . The second-order diffraction occurs at 42.0?

|

|

What is the difference in their offers in terms of dollars

: Your computer manufacturing firm must purchase 10,000 keyboards from a supplier. One supplier demands a payment of $100,000 today plus $10 per keyboard payable in one year. Another supplier will charge $21 per keyboard, also payable in one year. The ..

|

|

Evaluate the freezing point and the boiling point

: Calculate the freezing point and the boiling point of each of the following aqueous solutions. (Assume complete dissociation.) (a) 0.032 m MgCl2

|

|

Evaluate the freezing-point depression and osmotic

: Calculate the freezing-point depression and osmotic pressure at 25°C of an aqueous solution containing 8.6 g/L of a protein (molar mass = 9.0 104 g/mol) if the density of the solution is 1.0 g/cm3.

|

|

Define what is the ph of the resulting solution

: If 20mL of .10M NaOH is added to 45mL of .20M HC2H3O2, what is the pH of the resulting solution at 25 degrees Celsius

|

|

Determine the mass of earth from the period

: The mean distance of Mars from the Sun is 1.52 times that of Earth from the Sun. Determine the mass of Earth from the period T

|