Reference no: EM131430806

Please answer the following questions:

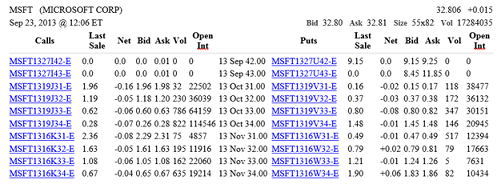

1. You are provided with the following options quote from CBOE:

a) What is the current stock price?

b) What is the immediate payoff if the $31 strike, October Call Option is exercised right now?

c) What is the immediate payoff if the $31 strike, October Put Option is exercised right now?

d) Why is the call option cheaper if the exercise price is higher?

e) Why is a put option more expensive if the exercise price is higher?

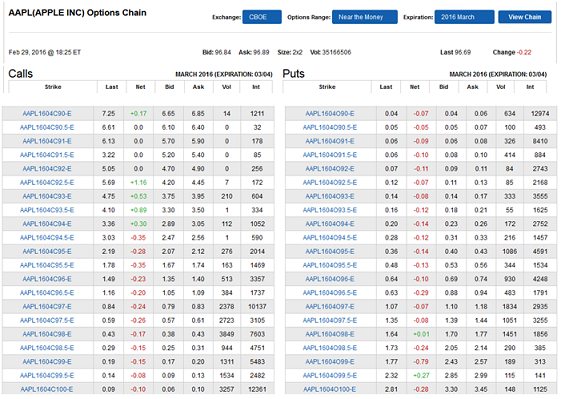

2. You are provided with the following options quote from CBOE:

a) Construct a covered call using the $96.5 strike option and graph the profits at expiration.

b) Construct a Bull Spread using the $94 and $97 call options and graph the profits at expiration.

c) Suppose the risk-free interest rate is 0.11%, and the options expire on March 18, 2016, verify whether the put-call parity holds for the $96 strike options. (The condition holds if the condition is within $1 difference then arbitrage is not possible due to transactions costs.)

Attachment:- Assignment Files.rar