Reference no: EM131567379

Financial Management Midterm

Bonds -

1. ABC Corp. issued a corporate bond with a face value of $1000. The coupon rate is lower than the yield to maturity. The price of the bond should be:

A) Less than $1000.

B) More than $1000.

C) Equal to $1000.

D) Not enough information.

2. A company issues a 6-year corporate bond with a face value of $1000 and a credit rating of B. The yield to maturity is 6% and the price of the bond is $900.

a. The bond is selling at a discount (D), premium (P), par value (A): ______

b. The coupon rate is: ______

c. The current yield is: ______

One year after the bond is issued the yield to maturity is 5%. What is the rate of return?

d. The price of the bond should be: ______

e. The rate of return is: ______

Two years after the bond is issued the rating on the bond changes to an A grade rating. What happens to the following?

Please indicate whether it increases (I), decreases (D) or stays the same (S)?

f. The bond's yield to maturity _____

g. The bond's price _____

h. The bond's coupon rate _____

i. The bond's current yield _____

Stocks -

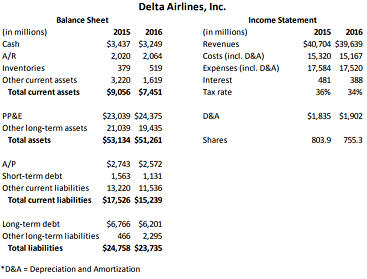

1. Assume the assets could actually be sold for $60bn and that it would only take $20bn to settle all of their liabilities.

a. What is the book value of Delta's equity?

b. What is the liquidation value of Delta's equity?

c. What is the market value of Delta's equity?

d. Why is the liquidation value different than the book value? (I don't want the definition, I want to know the reason for the difference).

e. Why is the market value different than the liquidation value? (I don't want the definition, I want to know the reason for the difference)

2. What is Delta's dividend yield?

3. What is Delta's payout ratio?

4. What is Delta's P/E ratio?

5. If I believe the fair P/E for Delta is 12x, how much would a share of Delta's stock be worth?

6. If you had bought Delta's stock one year ago when it was $39.26, what would your rate of return have been?

7. I expect Delta's dividends to be $1.00 next year, $2.00 two years from now, and $3.00 in three years. I also expect Delta's dividend after year 3 to grow at 3% forever, and my required return is 8%.

a. What would the value of Delta's stock price be in year 3 immediately after the dividend had been paid (hint: remember that in order to find the value of a perpetuity in t=0 you use CF in t=1)?

b. What would a share of Delta's stock be worth today?

8. How risky (volatile) is Delta's stock compared to the entire stock market?

a. much less

b. slightly less

c. slightly more

d. much more

How do you know this?

9a. What percent of all large-cap actively managed U.S. focused funds performed better than a passive investment in the S&P 500 over the past 15 years?

Capital Budgeting - Techniques

1. A project has an initial cost (year 0) of $50,000, cash inflows of $20,000 per year for 7 years (end of each year), and a discount rate of 11%.

a. What is the NPV?

b. What is the IRR?

c. What is the Profitability Index?

d. What is the payback period?

2. What is the...

a. NPV rule?

b. IRR rule?

c. Payback rule?

d. Profitability index rule?

3. When a project's internal rate of return is greater than its opportunity cost of capital, then what do we know about net present value?

4. If a project has an internal rate of return of well above 0%, it should be accepted. (T/F)

5. If a project has a Payback period of only 2.5 years, it should be accepted. (T/F)

6. When is the profitability index useful?

7. SFE Inc has $25 million to invest in the following projects. Which projects should it pursue?

Project Investment NPV

B 10,000,000 2,000,000 (.20)

U 12,000,000 9,000,000 (.75)

R 8,000,000 10,000,000 (1.25)

T 2,000,000 500,000 (.25)

O 6,000,000 3,000,000 (.50)

N 4,000,000 1,600,000 (.4)

Capital Budgeting - Cash Flows

1. When is it appropriate to include sunk costs in the evaluation of a project?

2. Your firm purchased machinery for $20 million 6 years ago. It has been depreciated straight-line over an assumed 10-year life, but it can now be sold for $10 million. The firm's tax rate is 38%. What is the after-tax cash flow from the sale of the equipment?

3. Using the financial statements for Delta on page 4, calculate the following:

a) What is EBIT?

b) What is Net Income?

c) What is Operating Cash Flow?

d) What is Total Cash Flow? Hint: you can assume the change in PP&E is CF from capital investments.

e) What is the amount of annual depreciation tax shield?

4. Will the following changes in working capital accounts result in an increase or decrease in cash flows? Please indicate whether it increases (I), decreases (D) or stays the same (S)?

a. $30,000 increase in accounts receivable ______

b. $15,000 decrease in inventories ______

c. $20,000 decrease in accounts payable ______

d. $5,000 increase in other current assets ______

e. $10,000 decrease in other current liabilities ______

f. $25,000 increase in equipment and machinery ______

g. What is the total effect? $___________

Capital Budgeting - Long Answer

1. Ugurt is considering the possibility of opening a new store. The cost of the fit-out of the store and the equipment would be $120,000 today and will be depreciated straight-line over 10 years to a salvage value of $20,000. Ugurt anticipates that the equipment can be sold in 10 years for $30,000 before tax. The store is expected to sell 50,000 ounces of frozen yogurt each month. The sales price is $0.30 per ounce. The cost of production is $0.05 per ounce. The fixed cost of the business is $10,000 per month. The new store will require an initial one-time increase in working capital, mainly yogurt and toppings, of $5,000. The working capital will not change throughout the life of the store and will be fully recaptured at the end of the project in 10 years. The firm's marginal tax rate is 40% and the discount rate is 10%. Should Ugurt open the new location? You must show your work to receive any credit.

a) What is the initial cash flow today (year 0)?

b) What are the cash flows each year in years 1-9?

c) What is the total cash flow in the final year (year 10)?

d) What is the NPV of this investment? What is the IRR of this investment? What is the payback period?

e) Should Ugurt open the new store?