Reference no: EM13837584

Track Software, Inc.

Seven years ago, after 15 years in public accounting, Stanley Booker, CPA, resigned his position as manager of cost systems for Davis, Cohen, and O'Brien Public Accountants and started Track Software, Inc. In the 2 years preceding his departure from Davis, Cohen, and O'Brien, Stanley had spent nights and weekends developing a sophisticated cost-accounting software program that became Track's initial product offering. As the firm grew, Stanley planned to develop and expand the software product offerings, all of which would be related to streamlining the accounting processes of medium- to large-sized manufacturers.

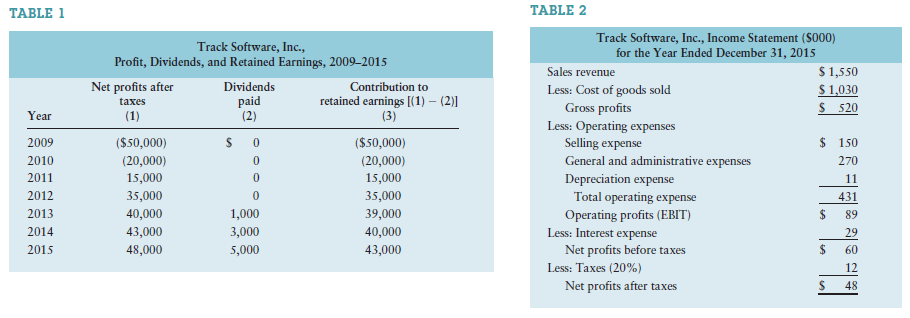

Although Track experienced losses during its first 2 years of operation-2009 and 2010-its profit has increased steadily from 2011 to the present (2015). The firm's profit history, including dividend payments and contributions to retained earnings, is summarized in Table 1.

Stanley started the firm with a $100,000 investment: his savings of $50,000 as equity and a $50,000 long-term loan from the bank. He had hoped to maintain his initial 100 percent ownership in the corporation, but after experiencing a $50,000 loss during the first year of operation (2009), he sold 60 percent of the stock to a group of investors to obtain needed funds. Since then, no other stock transactions have taken place. Although he owns only 40 percent of the firm, Stanley actively manages all aspects of its activities; the other stockholders are not active in management of the firm. The firm's stock was valued at $4.50 per share in 2014 and at $5.28 per share in 2015.

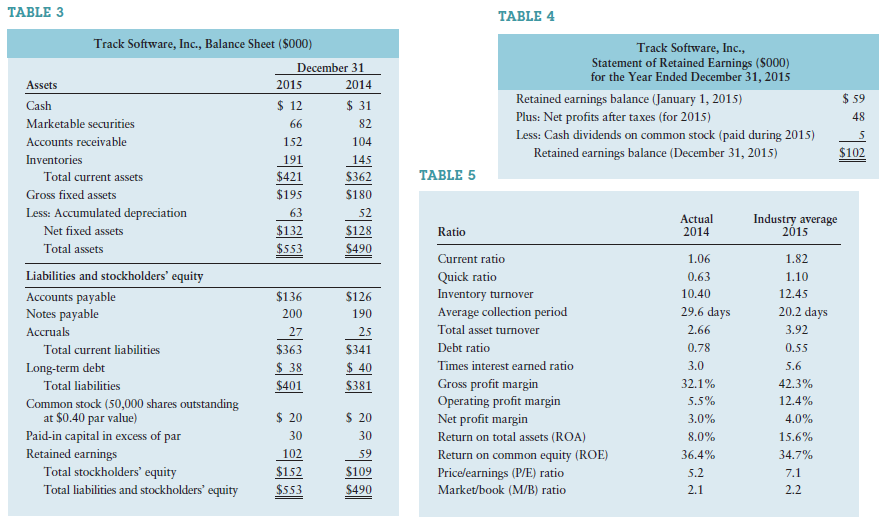

Stanley has just prepared the firm's 2015 income statement, balance sheet, and statement of retained earnings, shown in Tables 2, 3, and 4, along with the 2014 lance sheet. In addition, he has compiled the 2014 ratio values and industry :rage ratio values for 2015, which are applicable to both 2014 and 2015 and summarized in Table 5. He is quite pleased to have achieved record earnings of 8,000 in 2015, but he is concerned about the firm's cash flows. Specifically, he is finding it more and more difficult to pay the firm's bills in a timely manner and generate cash flows to investors, both creditors and owners. To gain insight into se cash flow problems, Stanley is planning to determine the firm's 2015 operating; cash flow (0CF) and free cash flow (FCF).

Stanley is further frustrated by the firm's inability to afford to hire a software developer to complete development of a cost estimation package that is believed to have "blockbuster" sales potential. Stanley began development of this package 2 years ago, but the firm's growing complexity has forced him to devote more of his time to administrative duties, thereby halting the development of this product. Stanley's reluctance to fill this position stems from his concern that the added $80,000 per year in salary and benefits for the position would certainly lower the firm's earnings per share (EPS) over the next couple of years. Although the project's success is in no way guaranteed, Stanley believes that if the money were spent to hire the software developer, the firm's sales and earnings would significantly rise once the 2- to 3-year development, production, and marketing process was completed.

With all these concerns in mind, Stanley set out to review the various data to develop strategies that would help ensure a bright future for Track Software. Stanley believed that as part of this process, a thorough ratio analysis of the firm's 2015 results would provide important

additional insights.

TO DO

a. (1) on what financial goal does Stanley seem to be focusing? Is it the correct goal? Why or why not? (2) Could a potential agency problem exist in this firm? Explain.

b. Calculate the firm's earnings per share (EPS) for each year, recognizing that the number of shares of common stock outstanding has

remained unchanged since the firm's inception. Comment on the EPS performance in view of your response in part a.

c. Use the financial data presented to determine Track's operating cash flow (OCF) and free cash flow (FCF) in 2015. Evaluate your findings in light of Track's cur-rent cash flow difficulties.

d. Analyze the firm's financial condition in 2015 as it relates to (1) liquidity, (2) activity, (3) debt, (4) profitability, and (5) market, using the financial statements provided in Tables 2 and 3 and the ratio data included in Table 5. Be sure to evaluate the firm on both a cross-sectional and a time-series basis.

e. What recommendation would you make to Stanley regarding hiring a new soft-ware developer? Relate your recommendation here to your responses in pan a.

f. Track Software paid $5,000 in dividends in 2015. Suppose that an investor approached Stanley about buying 100% of his firm. If this investor believed that by owning the company he could extract $5,000 per year in cash from the company in perpetuity, what do you think the investor would be willing to pay for the firm if the required return on this investment is 10%?

g. Suppose that you believed that the FCF generated by Track Software in 2015 could continue forever. You are willing to buy the company in order to receive this perpetual stream of free cash flow. What are you willing to pay if you re-quire a 10% return on your investment?

Read the Track Software case (Integrative Case 2) in your textbook and answer questions a-g at the end of the case. The case is cumulative and incorporates concepts learned throughout the course. Keep the following in mind as your complete the assignment:

• Unless otherwise noted by your instructor, each question is worth 10 points.

• In question b, calculate EPS for each year 2009-2015.

• In question d, make sure to include each ratio listed in Table 5 of the case for both 2014 and 2015. You will have to calculate the 2015 ratio values.

• For question d, you are required to write an evaluation of each area of performance as part of your answer. Merely citing numerical ratio values will not earn full credit.

• Note that your answers for questions f and g do not necessarily match.

Answer all questions on an Excel spreadsheet using the same guidelines for spreadsheet development used for your homework

assignments. See Guidelines for Developing Spreadsheets" for a full description of additional requirements.

• Submit a single spreadsheet file for this assignment, do not submit multiple files.

• Answer each question on a different spreadsheet tab.

• Label all numbers, both variables and the final answer.

• Use the yellow highlighter on Excel's top menu bar to highlight your final answer.

This assignment uses a grading rubric. Instructors will be using the rubric to grade the assignment; therefore, students should review the rubric prior to beginning the assignment to become familiar with the assignment criteria and expectations for successful completion of the assignment.