Reference no: EM131814743

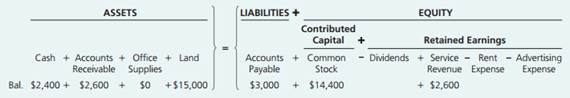

Question: A Using the accounting equation for transaction analysis Missy Mansion opened a public relations firm called Solid Gold on August 1, 2016. The following amounts summarize her business on August 31, 2016:

During September 2016, the business completed the following transactions:

a. Missy Mansion contributed $8,000 cash in exchange for common stock.

b. Performed service for a client and received cash of $1,300.

c. Paid off the beginning balance of accounts payable.

d. Purchased office supplies from OfficeMax on account, $400.

e. Collected cash from a customer on account, $2,200.

f. Cash dividends of $1,800 were paid to stockholders.

g. Consulted for a new band and billed the client for services rendered, $6,500.

h. Recorded the following business expenses for the month: Paid office rent: $1,400. Paid advertising: $350.