Reference no: EM13882788

1. The goal of financial management is to increase the:

a. Future value of the firm's total equity.

b. Book value of equity.

c. Dividends paid per share.

d. Current market value per share.

e. Number of shares outstanding.

2. Which one of the following best describes the primary intent of the Sarbanes-Oxley Act of 2002?

a. Increase the costs of going public

b. Increase protection against corporate fraud

c. Limit secondary issues of corporate securities

d. Decrease the number of publicly traded firms

e. Increase the number of firms that "go dark"

3. The financial statement that summarizes a firm's accounting value as of a particular date is called the:

a. income statement.

b. cash flow statement.

c. liquidity position.

d. balance sheet.

e. periodic operating statement.

4. Which one of the following has nearly the same meaning as free cash flow?

a. Net income

b. Cash flow from assets

c. Operating cash flow

d. Cash flow to shareholders

e. Addition to retained earnings

5. Financial statement analysis:

a. is primarily used to identify account values that meet the normal standards.

b. is limited to internal use by a firm's managers.

c. provides useful information that can serve as a basis for forecasting future performance.

d. provides useful information to shareholders but not to debt holders.

e. is enhanced by comparing results to those of a firm's peers but not by comparing results to prior periods.

6. A firm has inventory of $11,400, accounts payable of $9,800, cash of $850, net fixed assets of $12,150, long-term debt of $9,500, accounts receivable of $6,600, and total equity of $11,700. What is the common-size percentage for the net fixed assets? CLEARLY COMPUTE HERE.

a. 19.60 percent

b. 26.67 percent

c. 39.19 percent

d. 42.08 percent

e. 48.75 percent

7. Computing the present value of a future cash flow to determine what that cash flow is worth today is called:

a. compounding.

b. factoring.

c. time valuation.

d. simple cash flow valuation.

e. discounted cash flow valuation.

8. Sam wants to invest $5,000 for 5 years. Which one of the following rates will provide him with the largest future value?

a. 5 percent simple interest

b. 5 percent interest, compounded annually

c. 6 percent interest, compounded annually

d. 7 percent simple interest

e. 7 percent interest, compounded annually

9. The Food Store is planning a major expansion for 4 years from today. In preparation for this, the company is setting aside $35,000 each quarter, starting today, for the next 4 years. How much money will the firm have when it is ready to expand if it can earn an average of 6.25 percent on its savings? CLEARLY COMPUTE HERE.

a. $528,409.29

b. $540,288.16

c. $610,411.20

d. $640,516.63

e. $662,009.14

10. A callable bond:

a. is generally call protected during the entire term of the bond issue.

b. generally will have a call protection period during the final three years prior to maturity.

c. may be structured to pay bondholders the current value of the bond on the date of call.

d. is prohibited from having a sinking fund also.

e. is frequently called at a price that is less than par value.

11. The primary purpose of protective covenants is to help:

a. reduce interest rate risk.

b. the issuer in case of default.

c. protect bondholders from issuer actions.

d. bondholders whose bonds are called.

e. convert bearer bonds into registered form.

12. Which one of the following is probably the most effective means of increasing investors' interest in an IPO?

a. Extending the lockup period

b. Issuing the IPO through a rights offering

c. Underpricing the IPO

d. Eliminating the quiet period

e. Eliminating the Green Shoe option

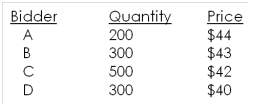

13. Northern Air would like to sell 700 shares of stock using the Dutch auction method. The bids received are as follows:

Bidder B will receive _____ shares and pay a price per share of _____. CLEARLY COMPUTE HERE.

a. 0; $0

b. 69; $42.25

c. 69; $42.00

d. 210; $42.00

e. $300; $40.00

14. Which one of the following actions is indicative of a restrictive short-term financial policy?

a. Granting increasing amounts of credit to customers

b. Expanding the number of inventory items carried

c. Increasing the firm's investment in the current accounts

d. Minimizing the cash balances held by the firm

e. Investing relatively large amounts in marketable securities

15. A committed line of credit:

a. guarantees that a set amount of funds will be available to a firm for a stated period of time regardless of events that might occur during that time period.

b. is a guarantee that a bank will purchase a firm's accounts receivables at full value.

c. provides greater assurance than a noncommitted credit line that funds will be available when needed by a firm.

d. guarantees that any funds borrowed during a stated period of time will be charged the lowest rate of interest the lending bank offers to any of its customers.

e. is a loan arrangement for a stated period of time which is free of all costs and fees other than the actual interest paid on the funds borrowed.

16. During the year, The Dalton Firm had sales of $3,210,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $2,540,000, $389,000, and $112,000, respectively. In addition, the company had an interest expense of $118,000 and a tax rate of 34 percent. (Ignore any tax loss carryback or carryforward provisions). What is its operating cash flow?

17. Global Ventures has a return on equity of 9.8 percent, a retention ratio of 60 percent, and a profit margin of 4.5 percent. The company paid $378 in dividends and has net working capital of $100. Net fixed assets are $18,550 and current liabilities are $520.

What is the total equity of the firm?

18. Capstone Crowns is considering a project that will produce cash inflows of $11,000 in year one, $24,000 in year two, and $36,000 in year three. What is the present value of these cash inflows if the company assigns the project a discount rate of 14 percent?

19. Johnson's Tree Farm has a cash balance of $33 and a short-term loan balance of $200 at the beginning of quarter one. The net cash inflow for the first quarter is $89 and for the second quarter there is a net cash outflow of $44. All cash shortfalls are funded with short-term debt. The firm pays 2 percent of its prior quarter's ending loan balance as interest each quarter. The minimum cash balance is $25. What is the short-term loan balance at the end of the first quarter?

20. One year ago, you purchased a 7.5 percent annual coupon bond for a clean price of $980. The bond now has 7 years remaining until maturity. Today, the yield to maturity on this bond is 6.87 percent. How does today's clean price of this bond compare to your purchase price?