Reference no: EM13380909

Question

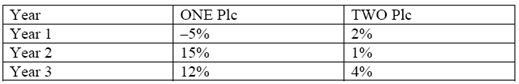

a) Over the past three years (Year 1 to Year 3) the stocks of two companies, ONE Plc and TWO Plc, generated annual returns to shareholders as follows:

i. For each of the three years (Year 1, Year 2, Year 3), calculate the annual return generated by a portfolio that is made up of the two stocks ONE and TWO with 80 percent of the portfolio invested in stock ONE and the rest in stock TWO.

ii. Based on the annual portfolio returns, calculate the expected portfolio return and the standard deviation of portfolio returns.

iii. Can the standard deviation of the portfolio returns be approximated as the weighted average of the individual stock returns? Explain why or why not.

b) Assuming the Capital Asset Pricing Model (CAPM) holds, calculate the expected returns and the risk premia of the following two portfolios.

1. Portfolio 1 has a beta of 1.5; the return on the market portfolio Rm is expected to be 8% and the riskfree rate Rf is 1%.

2. Portfolio 2: the estimated correlation coefficient between the returns on Portfolio 2 and the market portfolio returns is 0.1, the standard deviation of the market portfolio returns is 3%, and the standard deviation of the returns of Portfolio 2 is 8%; the values of Rm and Rf are as for Portfolio 1.

In each of parts (b1) - (b2), clearly show the derivation of your results.

(c) What is the security market line, and how has it been used in practice to quantify the equity cost of capital faced by a company?