Reference no: EM131234036

Part -1:

Assignment #1

THE SETTING

Country X is blessed with large reserves of natural resources, a spectacular physical landscape and a moderate climate. It is inhabited by a well educated and industrious workforce and has a parliamentary form of democracy.

The people in the country enjoy an impressive standard of living. Some concerns have however emerged in the recent times about the current state of the economy (Annexure 1 provides select information about broad economic settings for the country). The main factors that seem to have contributed to these concerns include: excessive reliance on primary commodities; perceptible shifts in international trade patterns - from primary commodities to high value-added products and services, low business and consumer confidence, low personal savings, inadequate productive investments, large national debt, disproportionately high imports, and a global economic downturn. The future economic prospects for the country do not look promising unless some concerted measures are taken to rectify the situation.

While several such measures (let us call them ‘proposals') are presently being considered by the government, a general consensus appears to be building around two proposals - Proposal A and Proposal B. Both proposals relate to investing in the infrastructure sector. Each of these proposals is likely to cost $40bn (2011 prices). Further, the government has decided that while the money for the project will be mobilized by the government, the projects will be implemented (i.e., built and operated) by the private sector. The underlying argument in support of these investment proposals is that they will stimulate economic activity and affect economic outcome in a multiplicative manner.

These proposals have generated considerable community-wide interest. Rightly so. The investments are large and their economic and societal implications are likely to be significant too. A careful evaluation of these proposals is therefore necessary. In view of the renown of UTS MEM graduates, you have been invited to evaluate these proposals.

You, of course, accept the invitation!

Task

Your task is simply to summarize (in your own hand-writing) the results of your analysis in the answer-sheet provided separately (you would be pleasantly surprised to discover how elegantly you are still able to write!).

Notes:

- You must provide the background details (i.e., select calculations) for various answers provided by you in the answer-sheet, in an Annexure (no more than one double-sided page). You must type-write your Annexure. The minimum permissible font size for the Annexure is 12 (Times Roman or equivalent).

- The completed answer-sheet must however be a stand-alone document (i.e., the reader should be able to understand the entire logic behind your reasoning without needing to refer to the Annexure.

- There is no tolerance on specified word/page limits. Any written material beyond these limits will not be marked.

- Please tick (√) only one box wherever multiple choices are provided.

- Although the country produced several types of commodities (goods and services) in the year 2006, but this country's Central Statistics Office has grouped such commodities into five broad categories (A to E) for the purpose of estimating private consumption and productive government expenditure for the year 2006.

|

Commodity

|

Production (bn units)

|

Price

($/unit; 2011 prices)

|

|

A

|

20

|

10 |

|

B

|

15

|

10 |

|

C

|

5

|

20 |

|

D

|

25

|

6 |

|

E

|

20

|

5 |

Further, during 2006, $40bn worth of shares were purchased by the citizen of the country. Total corporate profits for the year were $250bn, and dividends on shares, $10bn. The government also spent $30bn on social-security benefits, and provided $15bn of subsidies to the poor. The government received $60bn of direct taxation, and $30bn of indirect taxation, revenue during the year. The capital employed in the economy during the year was raised through a combination of borrowings, equity, and printing of money. The wages and salaries for this year amounted to $160bn, and $180bn was the cost of rent. $200bn of gross investments was made by the country during the year, and the assets depreciated by $30bn during the year. Net exports for the year were $0bn (all estimates for the year 2006 are expressed in terms of 2011 dollars.)

- For the year 2011, the government's direct taxation revenue was $80bn, and indirect taxation revenue, $40bn. The government spent $40bn on social-security benefits. The business paid, during the year, $160bn of rent for land. The cost of employing capital was

$180bn for this year (all prices are in 2016 dollars). Other particulars for 2011 (at 2016 prices, expressed in $bn include:

|

Total government transfer payments

|

80 |

|

Private consumption expenditure

|

500 |

|

Net exports (deficit)

|

(90) |

|

Net investment

|

160 |

|

Dividends issues by corporate sector

|

100 |

|

Government productive expenditure

|

200 |

|

Wages/salaries

|

300 |

- National Income data for the year 2016 is shown below.

Estimated National Income data for 2016 ($bn; 2006 prices)

|

Government productive expenditure

|

200 |

|

Total exports

|

60 |

|

Direct taxes

|

40 |

|

Interest on capital

|

200 |

|

Corporate profits

|

210 |

|

Private consumption expenditure

|

600 |

|

Government transfer payments

|

70 |

|

Value Added

|

900 |

|

Net Investment

|

130 |

|

Indirect Taxes

|

100 |

- While it is difficult to precisely predict future economic growth, the country's leading economists believe that if no measures are taken to revitalize the economy in 2016, the economy will become stagnant and its effect would be reflected in the GDP for the year 2021. In order to estimate the GDP for 2021, the economists have aggregated the economy into three major sectors as shown below:

i = interest; w = wages/salaries; r = rent; p = profit;

m = intermediate inputs; s = market value of total output;

f = market value of output sold to final users.

Note: All values are in billions of dollars, expressed in 2021 prices.

Other select information for the year 2021 (in 2021 prices) is noted below:

|

Gross National Expenditure (GNE)

|

1200 |

|

Depreciation

|

100 |

|

Direct taxes

|

100 |

|

Indirect taxes

|

100 |

|

Total imports

|

90 |

|

Transfer payments

|

200 |

|

Subsidies

|

100 |

- If however measures are taken to revitalize the economy (in this instance - by investing in Proposal A or Proposal B) in 2016, the GDP for the year 2021 could be affected - due to the multiplicative effect of investments. For Proposal A, for example, GDP will be roughly equal to the ‘without investment GDP' for 2021, plus investment inclusive of the multiplicative effect. The average value of the investment multiplier for investment in Project A can be determined from the following information:

Table 1:Income and Savings (Real $)

|

Year

|

Average Disposable Income

|

Average Consumption

|

|

1

|

50,000

|

50,000

|

|

2

|

51,000

|

52,000

|

|

3

|

52,000

|

54,000

|

|

4

|

53,000

|

56,000

|

|

5

|

54,000

|

58,000

|

- The GDP of the country, inclusive of the multiplicative effect of investment, for Proposal B, for the year 2021, can be estimated from the following simplified representation of the country's economy: The total value of the output produced by all firms in the country is estimated to be $1150bn. Of this output, $100bn worth of output is expected to be kept aside by the firms to build inventories for the future, and $200bn will be sold to other firms as intermediate inputs. In that year, the production processes are estimated to consume $300bn worth of intermediate inputs (raw materials), and the corporate sector is estimated to suffer a loss of $200bn.The indirect taxes in that year are estimated to be $100bn, and $150bn will be paid for rent.. Further, the government will pay $100bn of assistance to the economically disadvantaged in that year. Wages and salaries during the year are expected to be $200bn. All these estimates are in 2016 prices.

- Assume that the investments in either of the proposals will not cause any inflationary pressures.

Additional Information

- With 2016 as the base year, the GDP deflators for the various years can be estimated from information provided in Table 2. In this table the country's statisticians have grouped the entire economic activity of the country into three hypothetical commodities (A, B and C).

The levels of output and price of each commodity for the years 2006, 2011, 2016, and 2021 are shown in the table. Assume that the outputs produced are entirely purchased by the final users.

Table 2: Outputs and Prices

| Commodity |

2006 |

2011 |

2016 |

2021 |

|

Output |

Price |

Output |

Price |

Output |

Price |

Output |

Price |

| A |

10 |

20 |

10 |

10 |

15 |

12 |

20 |

18 |

| B |

10 |

16 |

20 |

16 |

15 |

18 |

25 |

30 |

| C |

20 |

20 |

30 |

20 |

35 |

25 |

20 |

10 |

Output - Physical units; Price - $/unit of physical output;

Notes: Please note that this table is meant exclusively for developing estimates of GDP deflators. Various values for 2021 shown in this table represent ‘No Investment' situation.

Part -2:

PROPOSAL A

Financial

Proposal A envisages generation of electricity from water - a hydro-electric project. The useful economic life of this project is estimated to be 60 years. This project will generate 50,000 million (mn) units of electricity annually. Electricity will be sold to the public at a tariff of 10 cents per unit. The annual operation and maintenance costs are expected to be 2.5 percent of the capital cost.

Economic (Social)

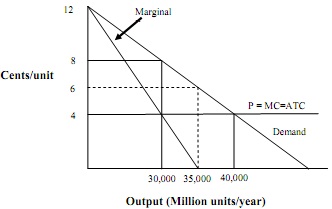

The economic (social) costs and benefits for this project must be estimated from Figure 1.

PROPOSAL B

Financial

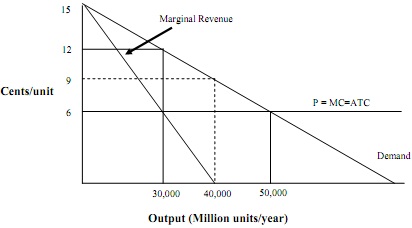

Proposal B is a thermal project - electricity will be generated from coal. The annual operating costs for this project are estimated to be 5 percent of the capital cost. This project will also have a useful economic life of 60 years. It will generate 50,000mn units of electricity annually. The electricity from this project will be sold at 12 cents per unit.

Economic (Social)

The economic (social) costs and benefits for this project can be estimated from Figure 2.

Task

Your task is simply to summarize (in your own hand) the results of your analysis in the answer-sheet provided separately.

Notes:

- You must provide the background details (i.e., select calculations), for various answers provided by you in the answer-sheet, in an Annexure (no more than one double-sided page). You must type-write your Annexure. You must not attach any computer-generated spread-sheets in the Annexure. The minimum permissible font size for the Annexure is 12 (Times Roman or equivalent).

- The completed answer-sheet must however be a stand-alone document (i.e., the reader should be able to understand the entire logic behind your reasoning without needing to refer to the Annexure. You must however provide (in the annexure) background calculations for the reasoning provided by you for each question in the answer-sheet.

- There is no tolerance on specified word/page limits. Any written material beyond these limits will not be marked.

- Please tick (√) only one box wherever a multiple choice is provided.

Assumptions (common to both proposals)

- All capital costs are incurred at time t=0 (i.e., ignore project construction time).

- Electricity generated, electricity tariffs, annual costs and the discount rate remain constant throughout the economic lives of the projects.

- The economic (social) costs and benefits must be estimated exclusively from Figures 1 and 2. The costs and benefits represented in these figures are all inclusive, i.e., total costs include capital and operating costs and the demand curves reflect of all benefits provided by the projects.

- For the purpose of estimation of economic (social) costs and benefits assume that the market structure for electricity sector is currently monopoly. It is expected to remain so for the first ten years of the project life-span. The government however proposes to transform this market initially into an oligopoly (for the years 11 to 30) and eventually competitive (years 31-60). While it is difficult to precisely estimate the price and quantity outcomes that will prevail in an oligopoly market, the economic brains of the time have suggested that these outcomes are as shown by dotted lines in Figures 1 and 2.

- The real and apparent annual discount rates are 10 and 15 percent, respectively. Further, the economic and financial discount rates can be assumed to be the same.

Figure 1 Economic (Social) Costs and Prices: Proposal A

Figure 2 Economic (Social) Costs and Prices: Proposal B

Figures 1 and 2 are Not-to-scale. Therefore, do not use these figures to estimate various areas. You should instead use values on X and Y axes to estimate various areas.