Reference no: EM13956246

1. Path of Bachelier Model:

Consider the Bachelier model for the stock (St) t≥0 :

St = S0 + a t + b Wt,

where (Wt) t≥0 is a Brownian motion and a, b > 0.

(a) Download daily data for the S&P 500 index for the twenty year period beginning in January 1994 until the end of 2013 (e.g., from yahoo finance). Use the data to estimate a and b for this model.

(b) Use Excel or another spreadsheet software to simulate a (discretized) sample path of a the Bachelier model over the year 2014 using 250 equidistant time steps, and compare it to the realized path. Just hand in the resulting plot.

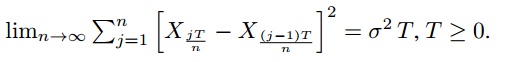

2. Quadratic Variation 1:

Let Xt = X0 + (µ − 0.5 σ 2 )t + σWt, where (Wt)t≥0 is a Brownian motion. You are given the following two statements concerning Xt.

(a) V ar[Xt+h − Xt] = σ 2 h, t ≥ 0, h ≥ 0.

Which of them is true? Provide an explanation for your answer.

|

Is this situation too sensitive to call without further

: Marketing estimates the probability of low demand as 35% with a probability of 65% that demand will be high. As the Business Intelligence Analyst what is your estimate of the overall return and best course of action?

|

|

What is the current stock price and intrinsic value of stock

: Pro Build Inc. has had a net income of $2 million in its most recent year. Net income is expected to grow by 3% per year. The firm always pays out 30% of net income as dividends and has 500,000 shares of common stock outstanding. The current cost of ..

|

|

Calculate the base-case cash flow and npv

: We are evaluating a project that costs $1,180,000, has a ten-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 66,000 units per year. What is the sensitivity of..

|

|

Discuss risk methodologies used in capital budgeting

: Apix is considering coffee packaging as an additional diversification to its product line. Here’s information regarding the coffee packaging project: What financial figure do you believe was the determinant to your decision and why? How would you be ..

|

|

Path of bachelier model

: 1. Path of Bachelier Model: Consider the Bachelier model for the stock (St) t≥0 :

|

|

What is the difference between an open-end mutual fund

: What is the difference between an open-end mutual fund and a closed-end fund? What is the difference between an open-end mutual fund and a unit investment trust?

|

|

Free cash flow during the just-ended year

: Mooradian Corporation’s free cash flow during the just-ended year (t = 0) was $150 million, and its FCF is expected to grow at a constant rate of 5.0% in the future. If the weighted average cost of capital is 12.5%, what is the firm’s total corporate..

|

|

Operates a chain of weight-loss centers for carb lovers

: Carbohydrates Anonymous (CA) operates a chain of weight-loss centers for carb lovers. Its services have been in great demand in recent years and its profits have soared. CA recently paid an annual dividend of $1.40 per share. If the market requires a..

|

|

Find the acceleration of the cart

: A woman on a bridge 75.0 m high sees a raft floating at a constant speed on a river below. She drops a stone from rest in an attempt to hit the raft. The stone is released when the raft has 7.00 m more to travel before passing under the bridge. Th..

|