Reference no: EM131143451

Write the answer of question given below related to the topic "Introduction to Financial Statement Analysis"2-1. What four financial statements can be found in a firm's 10-K filing? What checks are there on the accuracy of these statements?

2-2. Who reads financial statements? List at least three different categories of people. For each category, provide an example of the type of information they might be interested in and discuss why.

2-3. Find the most recent financial statements for Starbucks' corporation (SBUX) using the following sources:

a. From the company's Web site www.starbucks.com (Hint : Search for "investor relations.")

b. From the SEC Web site www.sec.gov. (Hint : Search for company filings in the EDGAR database.)

c. From the Yahoo! Finance Web site https://finance.yahoo.com.

d. From at least one other source. (Hint : Enter "SBUX 10K" at www.google.com.)

2-4. Consider the following potential events that might have occurred to Global Conglomerate on December 30, 2009. For each one, indicate which line items in Global's balance sheet would be affected and by how much. Also indicate the change to Global's book value of equity.

a. Global used $20 million of its available cash to repay $20 million of its long-term debt.

b. A warehouse fire destroyed $5 million worth of uninsured inventory.

c. Global used $5 million in cash and $5 million in new long-term debt to purchase a $10 million building.

d. A large customer owing $3 million for products it already received declared bankruptcy, leaving no possibility that Global would ever receive payment.

e. Global's engineers discover a new manufacturing process that will cut the cost of its flagship product by over 50%.

f. A key competitor announces a radical new pricing policy that will drastically undercut Global's prices.

2-5. What was the change in Global Conglomerate's book value of equity from 2008 to 2009 according to Table 2.1? Does this imply that the market price of Global's shares increased in 2009? Explain.

2-6. Use EDGAR to find Qualcomm's 10K filing for 2009. From the balance sheet, answer the following questions:

a. How much did Qualcomm have in cash and short-term investments?

b. What were Qualcomm's total accounts receivable?

c. What were Qualcomm's total assets?

d. What were Qualcomm's total liabilities? How much of this was long-term debt?

e. What was the book value of Qualcomm's equity?

2-7. Find online the annual 10-K report for Peet's Coffee and Tea (PEET) for 2008. Answer the following questions from their balance sheet:

a. How much cash did Peet's have at the end of 2008?

b. What were Peet's total assets?

c. What were Peet's total liabilities? How much debt did Peet's have?

d. What was the book value of Peet's equity?

2-8. In March 2005, General Electric (GE) had a book value of equity of $113 billion, 10.6 billion shares outstanding, and a market price of $36 per share. GE also had cash of $13 billion, and total debt of $370 billion. Four years later, in early 2009, GE had a book value of equity of $105 billion, 10.5 billion shares outstanding with a market price of $10.80 per share, cash of $48 billion, and total debt of $524 billion. Over this period, what was the change in GE's

a. market capitalization?

b. market-to-book ratio?

c. book debt-equity ratio?

d. market debt-equity ratio?

e. enterprise value?

2-9. In July 2007, Apple had cash of $7.12 billion, current assets of $18.75 billion, current liabilities of

$6.99 billion, and inventories of $0.25 billion.

a. What was Apple's current ratio?

b. What was Apple's quick ratio?c. In July 2007, Dell had a quick ratio of 1.25 and a current ratio of 1.30. What can you say about the asset liquidity of Apple relative to Dell?

2-10. In November 2007, Abercrombie and Fitch (ANF) had a book equity of $1458 million, a price per share of $75.01, and 86.67 million shares outstanding. At the same time, The Gap (GPS) had a book equity of $5194 million, a share price of $20.09, and 798.22 million shares outstanding.

a. What is the market-to-book ratio of each of these clothing retailers?

b. What conclusions can you draw by comparing the two ratios?2-11. Find online the annual 10-K report for Peet's Coffee and Tea (PEET) for 2008. Answer the following questions from the income statement:

a. What were Peet's revenues for 2008? By what percentage did revenues grow from 2007?

b. What were Peet's operating and net profit margin in 2008? How do they compare with its margins in 2007?

c. What were Peet's diluted earnings per share in 2008? What number of shares is this EPS based on?

2-12. Suppose that in 2010, Global launches an aggressive marketing campaign that boosts sales by 15%. However, their operating margin falls from 5.57% to 4.50%. Suppose that they have no

other income, interest expenses are unchanged, and taxes are the same percentage of pretax

income as in 2009.

a. What is Global's EBIT in 2010?

b. What is Global's income in 2010?

c. If Global's P/E ratio and number of shares outstanding remains unchanged, what is Global's share price in 2010?

2-13. Suppose a firm's tax rate is 35%.

a. What effect would a $10 million operating expense have on this year's earnings? What effect would it have on next year's earnings?

b. What effect would a $10 million capital expense have on this year's earnings if the capital is depreciated at a rate of $2 million per year for five years? What effect would it have on next year's earnings?

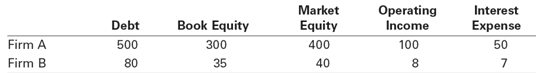

2-14. You are analyzing the leverage of two firms and you note the following (all values in millions of dollars):

a. What is the market debt-to-equity ratio of each firm?

b. What is the book debt-to-equity ratio of each firm?

c. What is the interest coverage ratio of each firm?

d. Which firm may have more difficulty meeting its debt obligations? Explain.

2-15. Quisco Systems has 6.5 billion shares outstanding and a share price of $18. Quisco is considering developing a new networking product in house at a cost of $500 million. Alternatively, Quisco can acquire a firm that already has the technology for $900 million worth (at the current price) of Quisco stock. Suppose that absent the expense of the new technology, Quisco will have EPS of

$0.80.

a. Suppose Quisco develops the product in house. What impact would the development cost have on Quisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense, Quisco's tax rate is 35%, and the number of shares outstanding is unchanged.

b. Suppose Quisco does not develop the product in house but instead acquires the technology. What effect would the acquisition have on Quisco's EPS this year? (Note that acquisition expenses do not appear directly on the income statement. Assume the firm was acquired at the start of the year and has no revenues or expenses of its own, so that the only effect on EPS is due to the change in the number of shares outstanding.)

c. Which method of acquiring the technology has a smaller impact on earnings? Is this method cheaper? Explain.

2-16. In January 2009, American Airlines (AMR) had a market capitalization of $1.7 billion, debt of

$11.1 billion, and cash of $4.6 billion. American Airlines had revenues of $23.8 billion. British

Airways (BABWF) had a market capitalization of $2.2 billion, debt of $4.7 billion, cash of $2.6 billion, and revenues of $13.1 billion.

a. Compare the market capitalization-to-revenue ratio (also called the price-to-sales ratio) for American Airlines and British Airways.

b. Compare the enterprise value-to-revenue ratio for American Airlines and British Airways.

c. Which of these comparisons is more meaningful? Explain.

2-17. Find online the annual 10-K for Peet's Coffee and Tea (PEET) for 2008.

a. Compute Peet's net profit margin, total asset turnover, and equity multiplier.

b. Use this data to compute Peet's ROE using the DuPont Identity.

c. If Peet's managers wanted to increase its ROE by one percentage point, how much higher would their asset turnover need to be?

d. If Peet's net profit margin fell by one percentage point, by how much would their asset turnover need to increase to maintain their ROE?

2-18. Repeat the analysis of parts (a) and (b) in Problem 17 for Starbucks Coffee (SBUX). Use the DuPont Identity to understand the difference between the two firms' ROEs.

2-19. Consider a retailing firm with a net profit margin of 3.5%, a total asset turnover of 1.8, total assets of $44 million, and a book value of equity of $18 million.

a. What is the firm's current ROE?

b. If the firm increased its net profit margin to 4%, what would be its ROE?

c. If, in addition, the firm increased its revenues by 20% (while maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?

2-20. Find online the annual 10-K report for Peet's Coffee and Tea (PEET) for 2008. Answer the following questions from their cash flow statement:

a. How much cash did Peet's generate from operating activities in 2008?

b. What was Peet's depreciation expense in 2008?

c. How much cash was invested in new property and equipment (net of any sales) in 2008?

d. How much did Peet's raise from the sale of shares of its stock (net of any purchases) in 2008?

2-21. Can a firm with positive net income run out of cash? Explain.

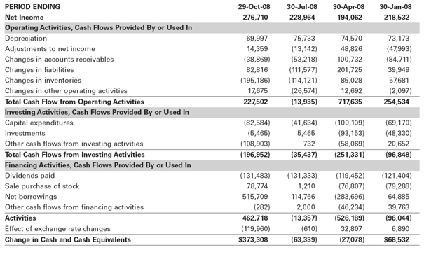

2-22. See the cash flow statement here for H. J. Heinz (HNZ) (in $ thousands):

a. What were Heinz's cumulative earnings over these four quarters? What were its cumulative cash flows from operating activities?

b. What fraction of the cumulative cash flows from operating activities was used for investment over the four quarters?

c. What fraction of the cumulative cash flows from operating activities was used for financing activities over the four quarters?

2-23. Suppose your firm receives a $5 million order on the last day of the year. You fill the order with

$2 million worth of inventory. The customer picks up the entire order the same day and pays $1 million upfront in cash; you also issue a bill for the customer to pay the remaining balance of $4 million in 30 days. Suppose your firm's tax rate is 0% (i.e., ignore taxes). Determine the consequences of this transaction for each of the following:

a. Revenues

b. Earnings

c. Receivables

d. Inventory

e. Cash

2-24. Nokela Industries purchases a $40 million cyclo-converter. The cyclo-converter will be depreciated by $10 million per year over four years, starting this year. Suppose Nokela's tax rate is 40%.

a. What impact will the cost of the purchase have on earnings for each of the next four years?

b. What impact will the cost of the purchase have on the firm's cash flow for the next four years?

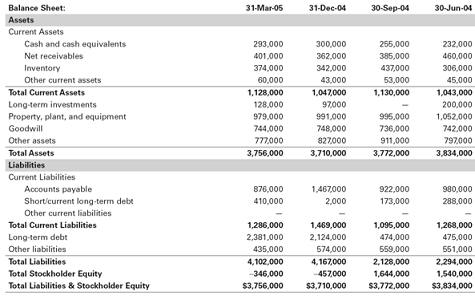

2-25. The balance sheet information for Clorox Co. (CLX) in 2004-2005 is shown here, with data in $ thousands:

a. What change in the book value of Clorox's equity took place at the end of 2004?

b. Is Clorox's market-to-book ratio meaningful? Is its book debt-equity ratio meaningful? Explain.

c. Find online Clorox's other financial statements from that time. What was the cause of the change to Clorox's book value of equity at the end of 2004?

d. Does Clorox's book value of equity in 2005 imply that the firm is unprofitable? Explain.

2-26. Find online the annual 10-K report for Peet's Coffee and Tea (PEET) for 2008. Answer the following questions from the notes to their financial statements:

a. What was Peet's inventory of green coffee at the end of 2008?

b. What property does Peet's lease? What are the minimum lease payments due in 2009?

c. What was the fair value of all stock-based compensation Peet's granted to employees in 2008? How many stock options did Peet's have outstanding at the end of 2008?

d. What fraction of Peet's 2008 sales came from specialty sales rather than its retail stores? What fraction came from coffee and tea products?

2-27. Find online the annual 10-K report for Peet's Coffee and Tea (PEET) for 2008.

a. Which auditing firm certified these financial statements?

b. Which officers of Peet's certified the financial statements?

2-28. WorldCom reclassified $3.85 billion of operating expenses as capital expenditures. Explain the effect this reclassification would have on WorldCom's cash flows. (Hint: Consider taxes.) WorldCom's actions were illegal and clearly designed to deceive investors. But if a firm could legitimately choose how to classify an expense for tax purposes, which choice is truly better for the firm's investors?