Reference no: EM1353326

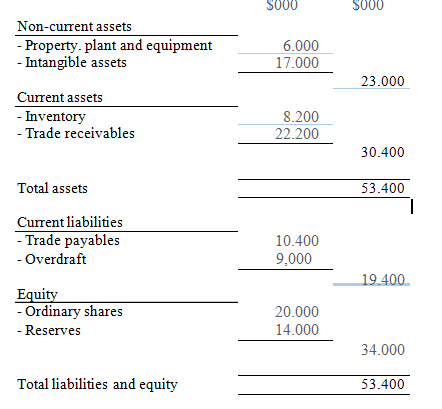

Question 1 Advent Software Limited (-Advent"). a company listed on the local stock exchange. provides software products and services for automating and integrating data and work flows. Its profit before interest and tax has fallen from $10 million to $2 million in the last year and its current financial position is as follows:

Advent has been advised by its bank that the current overdraft limit of $9 million will be reduced to $1 million in two months' time. The finance director of the firm has been unable to find another bank willing to offer alternative overdraft facilities and is planning to issue bonds on the stock market in order to finance the reduction of the overdraft.

The bonds would be issued at their par value of $100 per bond and would pay interest of 9% per year. payable at the end of each year. The bonds would be redeemable at a 10% premium to their par value after 10 years. The finance director hopes to raise $8 million from the bond issue.

The ordinary shares of Advent have a par value of $1.00 per share and a current market value of $8.00 per share. Its quoted beta is 1.5, current risk free rate of return is estimated at 3.5% and the market risk premium is 6%. The current interest rate on the overdraft is 5% per year. Taxation is at an annual rate of 17%.

Other financial information:

Average gearing of sector (debt/equity, market value basis) = 10%

Average interest coverage ratio of sector = 8 times

(a) Calculate the cost of equity and cost of debt.

Compute and comment on the effect of the bond issue on the weighted average cost of capital of Advent, clearly stating any assumptions that you make.

Calculate the effect of issuing bonds on the interest coverage ratio and gearing.

Analyse the proposal to use the bond issue to finance die reduction in the overdraft and discuss alternative sources of finance that could be considered by Advent, given its current financial position.

Question 2: Advent has annual sales revenue of $6 million and all sales are on 30 days' credit, although customers on average take ten days more than this to pay. Contribution represents 60% of sales and the company currently has no bad debts. Accounts receivable are financed by an overdraft at an annual interest rate of 5%.

Advent plans to offer an early settlement discount of 1.5% for payment within 15 days and to extend the maximum credit offered to 60 days. The company expects that these changes will increase annual credit sales by 5%, while also leading to additional incremental costs equal to 0.5% of turnover. The discount is expected to be taken by 30% of customers, with the remaining customers taking an average of 60 days to pay.

(a) Analyse whether the proposed changes in credit policy should be accepted.

(b) Identify and discuss the key areas of accounts receivable management.