Reference no: EM13825233

Problem-

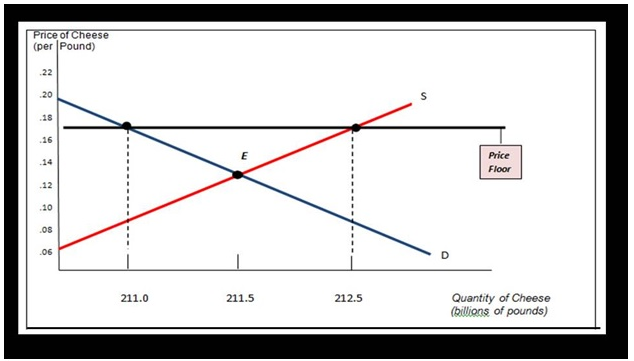

Suppose that the U.S. Department of Agriculture (USDA) administers the price floor for cheese, set at $0.17 per pound of cheese. (In real life the actual price floor was officially set at $16.10 per hundredweight of cheese. One hundredweight is 100 pounds.) At that price, according to data from the USDA, the quantity of cheese produced in 2009 by U.S. producers was 212.5 billion pounds, and the quantity demanded was 211 billion pounds. To support the price of cheese at the price floor, the USDA had to buy up 1.5 billion pounds of cheese. The accompanying diagram shows supply and demand curves illustrating the market for cheese.

a. In the absence of a price floor, the maximum price that a few of the consumers are willing to pay is $0.20 for a pound of cheese whereas the market equilibrium price is $0.13 per pound. The graph also shows that the minimum price at which a few of the producers are willing to sell is $0.06 per pound. In the absence of a price floor, how much consumer surplus is created?

b. How much producer surplus?

c. What is the total surplus?

d. The maximum price that a few of the consumers are willing to pay is $0.20 per pound of cheese, and the price floor is set at $0.17 per pound. With the price floor at $0.17 per pound of cheese, consumers buy 211 billion pounds of cheese. How much consumer surplus is created now?

e. The minimum price at which a few of the producers are willing to sell a pound of cheese is $0.06, and the price floor is set at $0.17 per pound. With the price floor at $0.17 per pound of cheese, producers sell 212.5 billion pounds of cheese (some to consumers and some to the USDA). How much producer surplus is created now?

f. The surplus cheese USDA buys is the difference between the quantity of cheese producers sell (212.5 billions of pounds of cheese) and the quantity of cheese consumers are willing to buy at the price floor (211 billions of pounds of cheese). How much money does the USDA spend on buying up surplus cheese?

g. Taxes must be collected to pay for the purchases of surplus cheese by the USDA. As a result, total surplus (producer plus consumer) is reduced by the amount the USDA spent on buying surplus cheese. Using your answers for parts d, e, and f, what is the total surplus when there is a price floor?

h. How does this compare to the total surplus without a price floor from part c?

Additional Information-

The problem belongs to Economics and it discuss about consumers' surplus, producers' surplus and total surplus for cheese produced in the year 2009 in the US.

|

Reducing the risk of oos or out-of-stock in retail industry

: Reducing the risk of OOS or Out-of-Stock in retail industry

|

|

Prepare a statement of financial position for the company

: This problem relates to Accounting and it is about preparation of statement of accounts which include income statement, cash flow and balance sheet statement for a fictitious company. Apart from the preparation of the statements of accounts, an in..

|

|

Federal unfair dismissal claim

: Allan had been employed by EW Services Pty Ltd for six years. The company, which employed 150 workers, operated an engineering workshop serving the local mining industry.

|

|

Price per unit-would produce positive contribution margin

: Homestead jeans co. has an annual plant capacity of 65,000 units, and current production is 45,000 units. Monthly fixed costs are 54,000 and variable costs are $29 per unit. prepare a differential analysis on whether to reject or accept the dawkins o..

|

|

How much producer surplus is created now

: The problem belongs to Economics and it discuss about consumers' surplus, producers' surplus and total surplus for cheese produced in the year 2009 in the US.

|

|

History of australia policy for accounting

: a concise history of Australia's policy for accounting for leases before the adoption of IFRS; the present approach taken by Australian IFRS on the question of recognition, measurement and presentation of leases, and the reasoning behind this approac..

|

|

what is the sunk cost-accumulated depreciation to date

: A company is considered replacing an old piece of machinery which cost 600,000 and has 350,000 of accumulated depreciation to date, with a new machine that costs 528,000. the old machine could be sold for 82,000. what is the sunk cost in this situat..

|

|

Net income and dividends using the equity method

: Record for Acquisitions, Inc., the purchase of the investment and its share of Takeover Target’s net income and dividends using the equity method.

|

|

Variable factory overhead cost associated with cases

: Eclipse Computer Company has been purchasing carrying cases for its portable computers at a delivered cost of $65 per unit. the company which is currently operating below full capacity charges factory overhead to production at the rate of 40% of dire..

|