Reference no: EM13381403

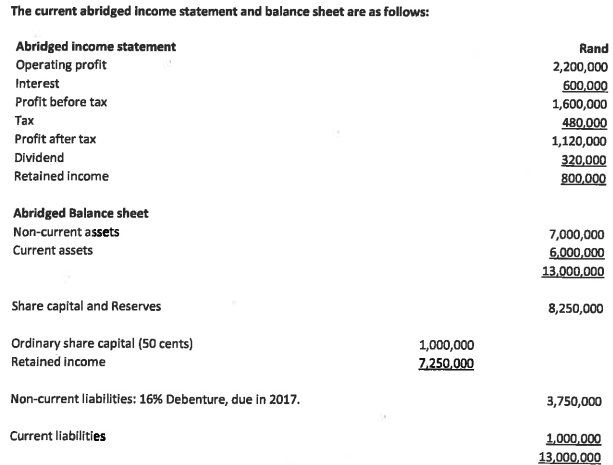

Gearing

Tobi Industries wishes to undertake a project that will cost R2 500 000. The project has already been evaluated and has a positive net present value.

The decision now facing management is how to finance the project. Three alternative financial 'packages' are under consideration:

• issue 1 250 000 new ordinary shares at 200 cents each; or

• Issue R2 500 000 Debenture, due In 2020, at a fixed rate of interest of 7%; or

• issue 1 000 000, 15%, R2.50 preference shares.

The project is expected to generate an extra R500 000 of earnings (before Interest and tax) each year. The company pays tax at 30% and follows a policy of paying a constant ordinary dividend per share.

Required:

1. Calculate the current earnings per share (EPS).

2. Calculate the current gearing (non-current debt/equity, using book value).

3. Calculate the revised EPS and gearing using ordinary share financing.

4. Calculate the revised EPS and gearing using debenture financing.

5. Calculate the revised EPS and gearing using preference share financing.

6. Prepare a brief report, with supporting evidence, recommending which of these three financing sources the company should use.