Reference no: EM132396513

FIT3158 Business decision modelling

Monash University

Assignment - Part 2

Natalia operates the Panamint Springs Resort, a small casino complex and hotel in rural Nevada in the US. She wants to use linear programming concepts to determine where to locate slot machines that come in five different types. Natalia has determined that machines of various types should be grouped together, reasoning that overall activity of the machines as a group will draw customers to them. The basic configuration of the slot area is established, beginning with assignments of leading slots to the corners and heavy foot traffic areas.

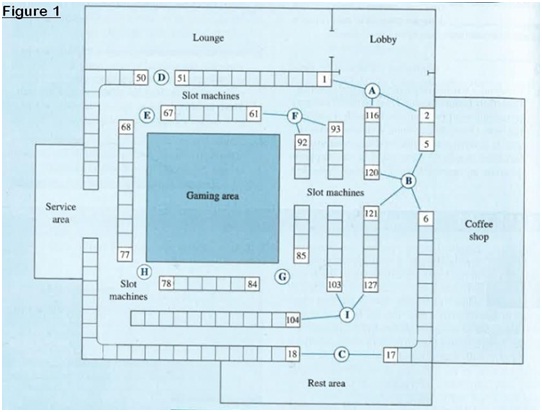

Figure 1 below shows a floor plan of the Panamint Springs casino area. Every slot location is represented by a small rectangle in the figure. Numbers are given as shown for the leading locations.

Figure 1 - Casino Area

Natalia wants to position machines of similar type throughout the casino in roughly the same proportion as the first 23 to be assigned to the leading locations in the Figure above. The following baseline mix of machines in Table 1 might be assigned in the first group.

Natalia wants to maximize 24-hour slot machine net receipts from the 23 strategic locations and their extended groups. Considering this context and considering the given data answer the following questions.

1.) Using foot traffic counts for the nearest strategic point and casino-wide average durations of play, determine Panamint Springs average 24-hour net receipts for each machine type and possible leading location for a group of identical machines. Present your working in Excel. (For simplicity we can assume there is always at least one free machine in any group.)

2.) Using the baseline machine mix, formulate and implement an LP model in Excel to find the optimal assignment for the 23 leading locations that will maximize Panamint Springs average 24-hour net receipts.

3.) Natalia feels that results in Question 1 does not reflect differences in major casino area types. Using the average playtime for the five areas in Table 4, instead of the casino-wide average used in Q1, determine Panamint Springs average 24-hour net receipts for each slot machine type and possible leading location for a group of identical machines. Present your working in Excel.

4.) Using the baseline machine mix, find the assignment for the 23 leading locations that will maximize Panamint Springs average 24-hour net receipts based on your answers to Question 3.

5.) Natalia wants to determine if there is a better machine mix than the baseline. Using the payoffs (average 24-hour net receipts) from Question 3, determine for each type mix (a) -(d) the optimal assignment for the 23 leading locations.

6.) Considering you answers to Q4 and Q5 which machine mix provides the maximum net receipts?

Assignment - Part 3

Ready Star Training (RST) is an award-winning training provider for the Australian Engineering and Manufacturing industry. Ready Star generally operates under contract with different employers to train a specified number of machinists proficient in the use of precision machine tools such as lathes, milling machines and grinders. Bowral Fabrications Inc. (BFI) is interested in having Ready Star provide a training program for its new machine technicians and has submitted a contract proposal. BFI requires a contract as it wants to ensure a steady supply of newly trained machine technicians to manage high growth across its multiple fabrication plants.

Ready Star Training (RST) has estimated that a 4-week certificate level machinist training course costs $3000 for the instructor, $700 for the machines and equipment facilities and $100 for office administration and support fees. In addition, BFI incurs an opportunity cost of $1500 per month for each machine technician, because they are being paid for the training duration but cannot be utilised productively.

1.) If BFI requires five trained machine technicians per month for the currently foreseeable future, how big should the training classes be to minimize the total annual relevant cost? Assume that according to the signed contract Ready Star Training guarantees that trained machinists will be available, and no shortages will apply. How many classes will be offered each year and what is the total annual relevant cost to be beared by BFI?

2.) If the class size found in 1.) is not an integer, round it (both up and down) and compare the affect on total annual relevant cost.

3.) An additional unexpected order from China has increased the demand for trained machinists at BFI for next year. Its estimated that as many as eight newly trained machine technicians will be required per month. Work out the answers for 1.) considering the new situation. What if a sudden decrease in orders has altered the demand for trained machinists to be four per month? Compare your answers in a table.

4.) Construct a data table and perform sensitivity analysis on total annual relevant cost for variability in the training associated opportunity cost of $1500 per month per each machine technician. Consider the cost to vary from $1000 to $2000 in $100 increments.

5.) In 1.) Ready Star Training (RST) has guaranteed that the trained technicians would be available as required. Now RST is not so sure and is thinking to renegotiate the contract allowing training delays. BFI is agreeable to some delays but has found that this would cost the company an additional $1600 per month. A 1-week delay would incur $400 in additional cost, 2-weeks $800 and so on. Find out how the delays would affect the answers in 1.).

6.) Suppose that BFI wants to have a policy that allows no more than 10% of the machinists to wait due to delay instead of putting a cost on the delay. Find how the answers in 5.) change. Consider that for a given service level L, shortage penalty can be imputed using the following formula.

P = (ch)L /( 1 - L)

Attachment:- Business Decision Modelling.rar