Reference no: EM131104846

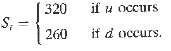

You are given the price of a nondividend paying stock St and a European call option Ct in a world where there are only two possible states

The true probabilities of the two states are given by {Pu = .5, Pd = .5}. The current price is St = 280. The annual interest rate is constant at r = 5%. The time is discrete, with Δ = 3 months. The option has a strike price of K = 280 and expires at time t + Δ.

(a) Find the risk-neutral martingale measure P* using the normalization by risk-free borrowing and lending.

(b) Calculate the value of the option under the risk-neutral martingale measure using

Ct = 1 / 1 +rΔ EP*[Ct+Δ]

(c) Now use the normalization by St and find a new measure P under which the normalized variable is a martingale

(d) What is the martingale equality that corresponds to normalization by St?

(e) Calculate the option's fair market value using the P.

(f) Can we state that the option's fair market value is independent of the choice of martingale measure?

(g) How can it be that we obtain the same arbitrage-free price although we are using two different probability measures?

(h) Finally, what is the risk premium incorporated in the option's price? Can we calculate this value in the real world? Why not?

|

Employment laws and the consequences of non-compliance

: Describe three employment laws and the consequences of non-compliance. Assess how an organization might structure their policies, practices or culture to ensure compliance.

|

|

Should you consider accepting the settlement

: After the case is over, the defendant's attorney calls your attorney and offers to settle the case for $7.5 million - Should you consider accepting the settlement? Explain why or why not?

|

|

Regulation of nation financial intermediaries

: Explain how savers and borrowers might benefit from regulation of nation's financial intermediaries. Does regulation impose costs? How do these costs affect long-run economic development.

|

|

What is the current market value of firms equity and debt

: What is the current market value of the firm's equity and debt? What is the required rate of return on the firm's equity? What is the beta of the equity? What is the firm's after tax WACC?

|

|

Find the risk-neutral martingale measure

: Find the risk-neutral martingale measure P* using the normalization by risk-free borrowing and lending.Calculate the value of the option under the risk-neutral martingale measure using Ct = 1 / 1 +rΔ EP*[Ct+Δ]

|

|

Have rizek and paine webber violated the common law

: Have Rizek and Paine Webber violated the common law of negligence or Securities Exchange Act Rule 10b-5?

|

|

A company uses exponential smoothing

: A company uses exponential smoothing with α = to forecast demand for a product. For each month, the company keeps a record of the forecast demand (made at the end of the preceding month) and the actual demand. Some of the records have been lost; ..

|

|

Unbalanced mix of employees

: A company's specific mix of individual employees combines to help produce an organization's culture and feel. In this assignment, you will evaluate how an unbalanced mix of employees can affect a company.

|

|

Compute the net income for the current year

: Compute the net income for the current year, assuming that there were no entries in the Retained Earnings account except for net income and a dividend declaration of $19,000 which was paid in the current year.

|