Reference no: EM13478415

QUESTION 1

a) Find the present value of an income stream that has a negative flow of RM100 per year for 3 years, a positive flow of RM200 in the 4th year, and a positive flow of RM300 per year in Years 5 through 8. The appropriate discount rate is 4% for each of the first 3 years and 5% for each of the later years. Thus, a cash flow accruing in Year 8 should be discounted at 5% for some years and 4% in other years. All payments occur at year-end.

b) Rahman is trying to determine the cost of health care to college students and parents' ability to cover those costs. He assumes that the cost of one year of health care for a college student is RM1,000 today, that the average student is 18 when he or she enters college, that inflation in health care cost is rising at the rate of 10% per year, and that parents can save RM100 per year to help cover their children's costs. All payments occur at the end of the relevant period, and the RM100/year savings will stop the day the child enters college (hence 18 payments will be made). Savings can be invested at a nominal rate of 6%, annual compounding. Rahman wants a health care plan that covers the fully inflated cost of health care for a student for 4 years, during Years 19 through 22 (with payments made at the end of Years 19 through 22). How much would the government have to set aside now (when a child is born), to supplement the average parent's share of a child's college health care cost? The lump sum the government sets aside will also be invested at 6%, annual compounding.

c) You are saving for the college education of your two children. One child will enter college in 5 years, while the other child will enter college in 7 years. College costs are currently RM10,000 per year and are expected to grow at a rate of 5% per year. All college costs are paid at the beginning of the year. You assume that each child will be in college for four years.

You currently have RM50,000 in your educational fund. Your plan is to contribute a fixed amount to the fund over each of the next 5 years. Your first contribution will come at the end of this year, and your final contribution will come at the date when you make the first tuition payment for your oldest child. You expect to invest your contributions into various investments, which are expected to earn 8% per year. How much should you contribute each year in order to meet the expected cost of your children's education?

QUESTION 2

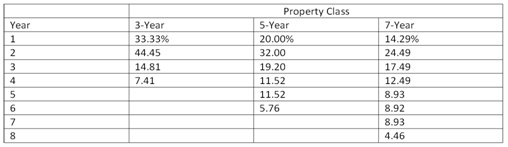

Benang Industrial Tools is considering a 3-year project to improve its production efficiency. Buying a new machine press for RM611,000 is estimated to result in RM193,000 in annual pretax cost savings. The press falls in the MACRS five-year class (table 1), and it will have a salvage value at the end of the project of RM162,000. The press also requires an initial investment in spare parts inventory of RM19,000, along with an additional RM2,000 in inventory for each succeeding year of the project. If the tax rate is 35 percent and the discount rate is 12 percent, should the company buy and install the machine press? Why or why not?

Table 1: Modified ACRS depreciation allowances

QUESTION 3

Briefly compare and contrast the NPV, PI and IRR criteria. Discuss the advantages and disadvantages of using each of these methods.

PART B

INSTRUCTION : Answer all question.

QUESTION 1

a) A 10-year, RM1,000 par value bond pays an 8% coupon with quarterly payments during its first five years (you receive RM20 a quarter for the first 20 quarters). During the remaining five years the security has a 10% quarterly coupon (you receive RM25 a quarter for the second 20 quarters). After 10 years (40 quarters) you receive the par value.

Another 10-year bond has an 8% semiannual coupon. This bond is selling at its par value, RM1,000. This bond has the same risk as the security you are thinking of purchasing.

Given this information, what should be the price of the security you are considering purchasing? Calculate and justify your answer.

b) Recently, SMJC Hospital Inc. filed for bankruptcy. The firm was reorganized as American Hospitals Inc., and the court permitted a new indenture on an outstanding bond issue to be put into effect. The issue has 10 years to maturity and an annual coupon rate of 10%. The new agreement allows the firm to pay no interest for 5 years. Then, interest payments will be resumed for the next 5 years. Finally, at maturity (Year 10), the principal plus the interest that was not paid during the first 5 years will be paid. However, no interest will be paid on the deferred interest. If the required annual return is 20%, what should the bonds sell for in the market today? Calculate and discuss your answer.