Reference no: EM131323465

A pension fund wants to enter into a six-month equity swap with a notional principal of $60 million. Payments will occur in 90 and 180 days. The swap will allow the fund to receive the return on a stock index, currently at 5,514.67.

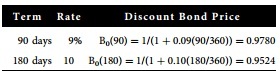

The fund is considering three different types of swaps, one of which would require it to pay a fixed rate, another that would require it to pay floating rate, and another that would require it to pay the return on another stock index, which is currently at 1,212.98. Refer to these as swaps 1, 2, and 3. The term structure is as follows:

a. Find the fixed rate for swap 1.

b. Find the payments on day 90 for swaps 1, 2, and 3. For swap 3, assume that on day 90 stock index 1 is at 5,609.81 and stock index 2 is at 1,231.94. Be sure to indicate the net payment.

c. Assume it is 30 days into the life of the swap. Stock index 1 is at 5,499.62, and stock index 2 is at 1,201.45. The new term structure is as follows:

|

Difference between leaders and managers

: Please view "The difference between leaders and managers" video (https://www.youtube.com/watch?v=0kCbpwcl0mc) before reading the case study below.

|

|

Distinguish between concurrent and predictive validity

: Distinguish between concurrent and predictive validity. Do these terms refer to types of construct validity or criterion-related validity?

|

|

Identify ways to enhance or optimize health

: Identify ways to enhance or optimize health in the selected focus area using evidence-based research. A minimum of three peer-reviewed articles must be utilized. Address the health disparity among different segments of the population for the select..

|

|

Discuss about the direct marketing

: Choose a creative group/ advertising agency name and design a logo. Your agency should specialize in direct marketing. Ten (10) extra credit points for the most creative name and 10 extra credit points for the best logo. Entrants must be compl..

|

|

Find the payments on day 90 for swaps

: Find the payments on day 90 for swaps 1, 2, and 3. For swap 3, assume that on day 90 stock index 1 is at 5,609.81 and stock index 2 is at 1,231.94. Be sure to indicate the net payment.

|

|

Project team recommendations to increase productivity

: Your boss has approved your project team's recommendations to increase productivity (select a specific organization that is applicable to you, if desired). Many of your recommendations will result in significant change to the organization. You h..

|

|

Evaluate three multi-cultural issues that could occur

: Evaluate three multi-cultural issues that could occur within a team and how the issues would impact the team. Create a plan that could be used to resolve multi-cultural issues.

|

|

Perform a financial analysis for a project

: Perform a financial analysis for a project XY. Assume the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $400,000 in Year 1 and $50,000 each year in Years 2, 3, and 4.

|

|

Explain roles functions and management approaches to leading

: BA500-Management: Write a 2,000-3,000 word paper from your instructor throughout the course using the Business Design outline below. Explain the roles, functions, and management approaches to leading

|