Reference no: EM132397158 , Length: word count : 500

FINC3017 Investments and Portfolio Management University of Sydney Australia

Report : Factor Backtesting and Performance Measurement

You are hired as an investment analyst in an Australian systematic asset management firm. Your portfolio manager asks you to prepare a report which investigates market anomalies in the U.S. equities market. Specifically, you are to report of the existence and performance of size, value, and low-beta anomalies, and use your results from single-factor backtesting to provide guidance on the development of a new

smart beta product. Your manager directs you to structure your report in three parts and address the following points:

Part A – Overview of Market Anomalies

1. Summarise the key characteristics of the following anomalies: (i) Size; (ii) Value; and (iii) Low Beta. Your summary should include a theoretical justification of each and make reference to key academic literature.

Part B – Comparing the Size Factor in Australia and U.S.

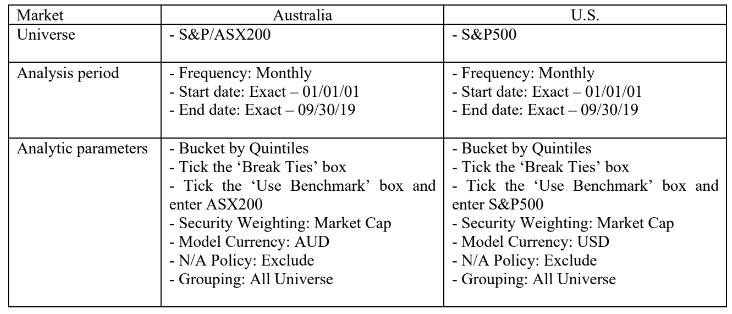

1. Using the FTST function in Bloomberg, conduct a single-factor smart beta backtest on the Size anomaly in

a. Australia, and

b. United States of America (U.S.)

2. Use the following parameters for your backtests:

3. Using the results from your backtests, make the following performance comparisons:

a. Measure the performance of the single-factor backtest in Australia against the passive investment alternative (i.e. ASX200)

b. Measure the performance of the single-factor backtest in U.S. against the passive investment alternative (i.e. S&P500)

c. Measure the performance of the single-factor backtest in Australia against the single- factor backtest in U.S.

Part C – Value and Low Beta Factors in a U.S. Strategy

1. Using the FTST function in Bloomberg, conduct the following two single-factor smart beta backtest in the U.S. using the same parameters as in Part B-2:

a. Value anomaly

b. Low Beta anomaly

2. Using the results from your backtests in C-1, measure and discuss the performance of the Value and Low Beta single-factor backtests against the passive investment alternative (i.e. S&P500 benchmark), and against each other.

3. With reference to your Value and Low Beta single-factor smart beta backtests, propose and justify a multi-factor smart beta strategy. Discuss why it should outperform a single-factor smart beta strategy.

4. Briefly describe any limitations to your analysis that should be considered alongside your findings.

Your report should conclude with an overall summary of your results.