Reference no: EM13178162

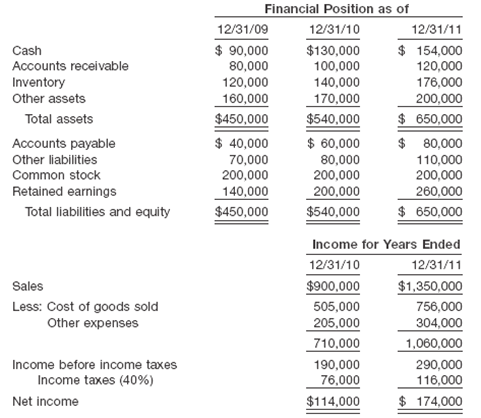

Financial Statement Effects of FIFO and LIFO the management of Tritt Company has asked its accounting department to describe the effect upon the company's financial position and its income statements of accounting for inventories on the LIFO rather than the FIFO basis during 2010 and 2011. The accounting department is to assume that the change to LIFO would have been effective on January 1, 2010, and that the initial LIFO base would have been the inventory value on December 31, 2009. Presented below are the company's financial statements and other data for the years 2010 and 2011 when the FIFO method was employed. Other data:

1. Inventory on hand at December 31, 2009, consisted of 40,000 units valued at $3.00 each.

2. Sales (all units sold at the same price in a given year):

2010-150,000 units @ $6.00 each 2011-180,000 units @ $7.50 each

3. Purchases (all units purchased at the same price in given year):

2010-150,000 units @ $3.50 each 2011-180,000 units @ $4.40 each

4. Income taxes at the effective rate of 40% are paid on December 31 each year. Name the account(s) presented in the financial statements that would have different amounts for 2011 if LIFO rather than FIFO had been used, and state the new amount for each account that is named. Show computations.

|

Fairness and reasonablennes of paula accounting policies

: Discuss the fairness and reasonablennes of paula accounting policies - revenue was recognized when cash was reveived from customers. most customers paid in cash but fer customers purchased and were allowed to pay in 30 days.

|

|

State substrate-level phosphorylation

: The ATP that is generated in glycolysis is produced by substrate-level phosphorylation, a very different mechanism than the one used to produce ATP during oxidative phosphorylation

|

|

What did the doctor say after examining yunn yunsberger

: What did the doctor say after examining Yunn Yunsberger.

|

|

State the concentration of oxygen in the arterial blood

: An otherwise healthy medical student visits pikes peak (barometric pressure of 450 mmHg) during spring break. druing her first hour on the peak, she was foced to rest at periodic intervals. Which of the following is increased?

|

|

Financial statement effects of fifo and lifo

: Inventory on hand at December 31, 2009, consisted of 40,000 units valued at $3.00 each - would have different amounts for 2011 if LIFO rather than FIFO had been used, and state the new amount for each account that is named

|

|

What is your monthly mortgage payment

: What is your monthly mortgage payment? How much does your house cost per month including principal, interest, real estate taxes, and insurance?

|

|

What monthly payment will john get

: John sells his house and earns a profit of $600,000. With the profit, he buys a 20 year annuity that earns 6.5% interest compounded monthly. What monthly payment will John get?

|

|

Agility-resilience in dealing-change in business environment

: How important do you think it will be for companies of the future to develop their agility and resilience in dealing with changes in their business environment?

|

|

What is the present value of this annuity

: Suppose a retiree wants to buy an ordinary annuity that pays her $2,000 per month for 20 years. If the annuity earns interest at 3.5% interest compounded monthly, what is the present value of this annuity?

|