Reference no: EM131423355

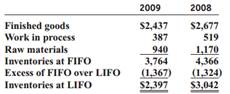

The following information was taken from the inventory footnote contained in the 2009 annual report of Deere & Company, the agricultural equipment manufacturer.

Most inventories owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the last-in, first-out (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the first-in, first-out (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 59 percent and 64 percent of worldwide gross inventories at FIFO value on October 31, 2009 and 2008, respectively.

REQUIRED:

a. Why would a potential investor or creditor who is considering investing in Deere be interested in the difference between LIFO and FIFO inventory values?

b. Explain why reducing certain inventory quantities, valued under LIFO, would increase net income and why an investor would be interested in such a disclosure.

c. Deere's effective tax rate is 34 percent. Approximately how much more income tax would Deere have paid if at the end of 2009 it switched to FIFO for all of its inventory?

d. Explain why Deere & Company might resist adopting IFRS.

|

How many participants were female

: PUBH 6033-A study was conducted to determine if a walking plus strength training exercise program results in a significantly greater increase in aerobic capacity as compared to a walking only exercise program. Participants are randomly selected a..

|

|

Create three years of income statements-balance sheets

: Create a 3 years of income statements, balance sheets, and cash flow statements. Create a 3–4 page financial summary detailing your income statements, balance sheets, and cash flow statements.

|

|

Use the addition rule for means of random variables

: What are the means and standard deviations of the two sample proportions p^1 and p^2?- Use the addition rule for means of random variables: what is the mean of D = p^1 - p^2?

|

|

Briefly describe the five stages of the product life cycle

: Briefly describe the five stages of the product life cycle. Listed below are three different organizations at various stages of the product life cycle. Describe the overall marketing objectives of each identified organization. Organization Life Cycle..

|

|

Explain why deere & company might resist adopting ifrs

: Why would a potential investor or creditor who is considering investing in Deere be interested in the difference between LIFO and FIFO inventory values?

|

|

Course is obligated unless the contract is terminated

: Marc's Beverage Company purchases bottles from Bob's Bottling Company at the rate of 10,000 bottles per week. Bob's Bottling Company produces bottles for many customers, not just Marc. Working with minimal inventory. Same facts as Question 1, but the..

|

|

Estimate of the difference in gender proportions

: Give an estimate of the difference in gender proportions that favored Commercial A. Also construct a large-sample 95% confidence interval for this difference.

|

|

Give an estimate of the difference in gender proportions

: Give an estimate of the difference in gender proportions that favored Commercial A. Also construct a large-sample 95% confidence interval for this difference.

|

|

Considered in the solution of the transportation table

: Suppose your supervisor asks you to use the transportion method to rearrange the desks of everyone in the office. How would you do it? What other factors are important but will not be considered in the solution of the transportation table?

|