Reference no: EM13490407

Relevant Costs and Transfer Pricing

AB Company specialises in electronic products. Division A makes integrated circuits and sells 90% of its output to outside companies. This division is operating well below capacity.

Division B has developed a new product codenamed XK120 that could use the circuit made by Division A. The manager of Division A has quoted a transfer price of $80 per circuit, which is below the current market price, and which would provide a $40 contribution margin.

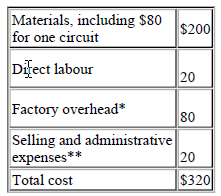

The accountant of Division B has provided the following estimates of costs for XK120:

* $40 fixed, $40 variable, **$10 fixed, *10 variable

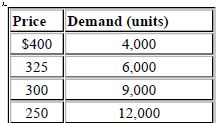

The marketing manager of Division B has submitted the following estimates of their demand schedule for XK120:

Division A has enough capacity to meet the 12 000 maximum volume that Division B could obtain.

Divisional managers are evaluated on ROI, and total investment would be the same for any of thevolumes that Division B may sell.

(a) As the manager of Division B, given the transfer price of $80, what price would you charge for XK120 and what volume would you sell?

(b) Given the price calculated in (a), what total contribution would be earned by:

(i) Division A?

(ii) Division B?

(d) From the point of view of the managing director of AB Company, what price should Division B charge for XK120, and what volume should be sold in order to maximise return on investment for the company as a whole?

(e) If the volume calculated in (c) were to be met, what is the minimum transfer price that could be accepted by Division A so that its total contribution would be no less than that calculated in (b)(i)?

(f) If the volume calculated in (c) were to be met, what is the maximum transfer price that could be paid by Division B so that its total contribution would be no less than that calculated in (b)(ii)? (4marks)

(g) If the managing director is determined that Division B should sell that volume which produces the optimum result for the company as a whole, what justification could be given to the divisional manager of Division A in requiring him to accept a transfer price equal to that calculated in (e)?

|

Evaluate the ka of this weak acid

: In a solution mixture of a 0.010M weak acid and 0.10M weak base, the measured pH was 4.75 at 24C. calculate the Ka of this weak acid. if 10mL of this mixture was then diluted with distilled water to a total volume of 100mL, what would be the new p..

|

|

How far is the rope pulled

: a 5.0*10^2 N laod is lifted 6.0 m with a pulley. the force exerted on the pulley rope is 165 N and the efficiency is 65 %. how far is the rope pulled

|

|

Calculate the contribution margin for each product

: Instead of producing the product mix in part (b), management wishes to use linear programming to find the profit-maximising mix. Write an LP model, and then use Excel's Solver to determine the optimum weekly mix and the resulting weekly profit ..

|

|

Define elimination competes with substitution

: Elimination competes with substitution. write an equation for the elimination reaction of 2 chloro 2 methylpropane in water

|

|

Explain relevant costs and transfer pricing

: AB Company specialises in electronic products. Division A makes integrated circuits and sells 90% of its output to outside companies. This division is operating well below capacity.

|

|

Explain what is the enthalpy of vaporization

: For a particular liquid, raising its temperature from 330 K to 353 K causes its vapor pressure to double. What is the enthalpy of vaporization of this liquid? (R = 8.31 J/(K· mol))

|

|

Determine the profitability of souvenir program production

: The State Opera Theatre gains significant revenue from ticket sales at each opera performed during the season. The sale of souvenir programs for all performances of each opera also adds to profitability.

|

|

Calculate the force that is acting on the mass

: A 5.0-kg mass starts from rest and accelerates to a velocity of 8.0 m/s in a time of 10.0 seconds. Calculate the force that is acting on the mass

|

|

Explain the molal freezing point depression of water

: if 11.3g of Ca(NO3)2 dissolves in 115.0g of water, the freezing point is depressed by -3.34C. from this data, what is the molal freezing point depression of water

|