Reference no: EM131129765

PROBLEMS

1. Grecian Tile Manufacturing of Athens, Georgia, borrows $1,500,000 at LIBOR plus a lending margin of 1.25 percent per annum on a six-month rollover basis from a London bank. If six-month LIBOR is 4 ½ percent over the first six-month interval and 5 3/8 percent over the second six-month interval, how much will Grecian Tile pay in interest over the first year of its Eurodollar loan?

2. A bank sells a "three against six" $3,000,000 FRA for a three-month period beginning three months from today and ending six months from today. The purpose of the FRA is to cover the interest rate risk caused by the maturity mismatch from having made a three-month Eurodollar loan and having accepted a six-month Eurodollar deposit. The agreement rate with the buyer is 5.5 percent. There are actually 92 days in the three-month FRA period. Assume that three months from today the settlement rate is 4 7/8 percent. Determine how much the FRA is worth and who pays who--the buyer pays the seller or the seller pays the buyer.

3. Assume the settlement rate in problem 2 is 6 1/8 percent. What is the solution now?

4. A "three-against-nine" FRA has an agreement rate of 4.75 percent. You believe six-month LIBOR in three months will be 5.125 percent. You decide to take a speculative position in a FRA with a $1,000,000 notional value. There are 183 days in the FRA period. Determine whether you should buy or sell the FRA and what your expected profit will be if your forecast is correct about the six-month LIBOR rate.

5. Recall the FRA problem presented as Example 11.2. Show how the bank can alternatively use a position in Eurodollar futures contracts (Chapter 7) to hedge the interest rate risk created by the maturity mismatch it has with the $3,000,000 six-month Eurodollar deposit and rollover Eurocredit position indexed to three-month LIBOR. Assume that the bank can take a position in Eurodollar futures contracts that mature in three months and have a futures price of 94.00.

6. The Fisher effect (Chapter 6) suggests that nominal interest rates differ between countries because of differences in the respective rates of inflation. According to the Fisher effect and your examination of the one-year Eurocurrency interest rates presented in Exhibit 11.3, order the currencies from the eight countries from highest to lowest in terms of the size of the inflation premium embedded in the nominal interest rates for June 2, 2010.

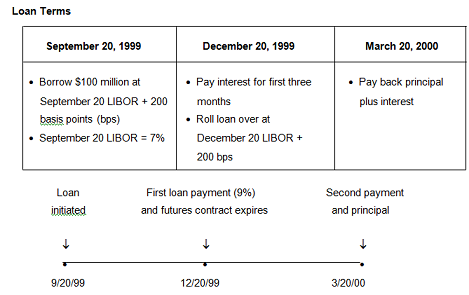

7. George Johnson is considering a possible six-month $100 million LIBOR-based, floating-rate bank loan to fund a project at terms shown in the table below. Johnson fears a possible rise in the LIBOR rate by December and wants to use the December Eurodollar futures contract to hedge this risk. The contract expires December 20, 1999, has a US$ 1 million contract size, and a discount yield of 7.3 percent.

Johnson will ignore the cash flow implications of marking to market, initial margin requirements, and any timing mismatch between exchange-traded futures contract cash flows and the interest payments due in March.

a. Formulate Johnson's September 20 floating-to-fixed-rate strategy using the Eurodollar future contracts discussed in the text above. Show that this strategy would result in a fixed-rate loan, assuming an increase in the LIBOR rate to 7.8 percent by December 20, which remains at 7.8 percent through March 20. Show all calculations.

b. Describe the strip hedge that Johnson could use and explain how it hedges the 12-month loan (specify number of contracts). No calculations are needed.

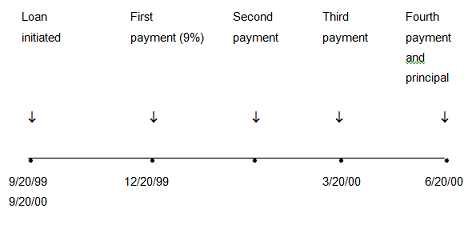

8. Jacob Bower has a liability that:

• has a principal balance of $100 million on June 30, 1998,

• accrues interest quarterly starting on June 30, 1998,

• pays interest quarterly,

• has a one-year term to maturity, and

• calculates interest due based on 90-day LIBOR (the London Interbank Offered

Rate).

Bower wishes to hedge his remaining interest payments against changes in interest rates.

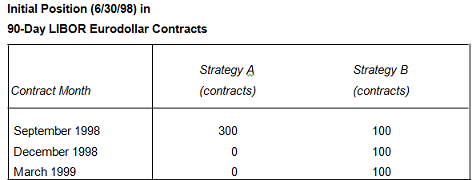

Bower has correctly calculated that he needs to sell (short) 300 Eurodollar futures contracts to accomplish the hedge. He is considering the alternative hedging strategies outlined in the following table

a. Explain why strategy B is a more effective hedge than strategy A when the yield curve undergoes an instantaneous nonparallel shift.

b. Discuss an interest rate scenario in which strategy A would be superior to strategy B.

|

Determine the number of gates needed to implement

: Determine the number of gates needed to implement an eight-bit carry-lookahead adder assuming that the maximum fan-in for the gates is four.

|

|

How does judy see the local living economy movement

: how would you characterize her approach to business, from a theoretical perspective (consider the theories about social responsibility we learned in class)?

|

|

Informational process analysis essay

: Write a draft of a 500-word informational process analysis essay. Choose a process you know well and explain it. Do not write about a process you need to research. Write about a process you are familiar with, and do not use outside sources.

|

|

Prepare the journal entry to record each bond transaction

: Halloway Company has issued three different bonds during 2010. Interest is payable semiannually on each of these bonds.

|

|

Eurodollar loan of grecian tile manufacturing of athens

: Grecian Tile Manufacturing of Athens, Georgia, borrows $1,500,000 at LIBOR plus a lending margin of 1.25 percent per annum on a six-month rollover basis from a London bank. If six-month LIBOR is 4 ½ percent over the first six-month interval and 5 3/8..

|

|

What kind of information from the sources

: Assess how you're currently using sources, what kind of information from the sources you're including, and what else you might want to include; what other type of source material might you need?

|

|

What is the distance of the farther star in parsecs

: If the measured parallax shift of star A is 0.1 arcsecs and the parallax shift of star B is 0.05 arcsecs, which star is farther away from the Earth, why? Using one of the formulas from the formula sheet, what is the distance of the farther star in ..

|

|

Discourse analysis about to work

: Here is a link of "How to Do a Discourse Analysis" by Florian Schneider.http://www.politicseastasia.com/studying/how-to-do-a-discourse-analysis/ Note that this introduction to "discourse analysis" comes from political science.

|

|

What are the main facts about the case

: What are the main facts about the case? Apply the fraud opportunity triangle to the case and illustrate how the case complies (or does not complies) with the triangle.

|