Reference no: EM13202347

Capital Budgeting Homework

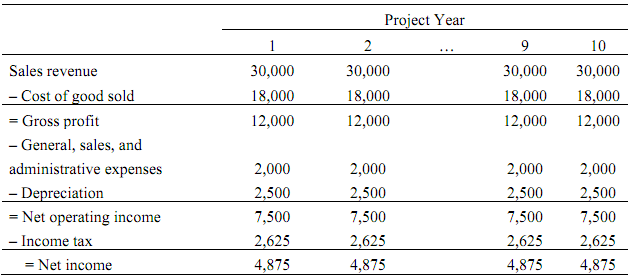

You are a manager at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dollars):

All of the estimates in the report seem correct. You note that the consultants used straight-line depreciation for the new equipment that will be purchased today (year 0), which is what the accounting department recommended. The report concludes that because the project will increase earnings by $4.875 million per year for ten years, the project is worth $48.75 million. You think back to your halcyon days in finance class and realize there is more work to be done! First, you note that the consultants have not factored in the fact that the project will require $10 million in working capital upfront (year 0), which will be fully recovered in year 10. Next, you see they have attributed $2 million of selling, general and administrative expenses to the project, but you know that $1 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting earnings are not the right thing to focus on! a. Given the available information, what are the Operation cash flows and Investment cash flow respectively in years 0 through 10 that should be used to evaluate the proposed project?

b. If the cost of capital for this project is 14%, what is your estimate of the value of the new project? What is the IRR of the new project? Should the firm invest in this project or not?

|

How many children attended the show

: At a certain screening with full attendance, there were half as many adults s children and students combined. The receiipts totaled $5600. How many children attended the show?

|

|

Write a fraction of the bucket

: suppose a bucket is placed under two facets. If one faucet is turned on alone, the bucket is filled in 5 minutes. Write a fraction of the bucket that will be filled in 1 minute.

|

|

Determine the amount alistair must deposit in june

: Alistair deposited $10,000 on July 1, 2005, in a first fund that gives interest of 31?2 percent compounded semiannually and matures on June 1, 2012. He knows that, on December 18, 2012, he can deposit money in a second fund.

|

|

What dimensions will give the largest printed area

: A poster has an area of 190 inches squared with 1 inch margins at the bottom and sides and a 3 inch margin at the top. What dimensions will give the largest printed area?

|

|

Estimate of the value of the new project

: what is your estimate of the value of the new project and what is the IRR of the new project? Should the firm invest in this project or not?

|

|

Compute the optimal pricing scheme of the iphone

: Suppose that technophiles are willing to pay $400 now for the latest iphone, but only $300 if they have to wait a year. Normal people are willing to pay $250 and their desire to purchase doesn't vary with time.

|

|

How fast is the height of the water increasing

: An upright cylindrical tank with a radius 5 m is being filled with water at a rate of 4 m cubed/minute. How fast is the height of the water increasing?

|

|

Let e be a metric space s a subset of e

: Let E be a metric space, S a subset of E, and let f:E-R be the function which takes the value 1 at each point of S and 0 at each point of the complement of S. Prove that the set of points of E at which f is not continuous is precisely the boundary..

|

|

What were main benefits from the activities of the goldsmith

: By writing more notes than the amount of gold held, the goldsmith could lend the notes and charge interest on them. Did the goldsmith bankers make money out of thin air in a form of legal theft What were the main benefits fromt he activities of the..

|