Reference no: EM131690248

Qusetion: Assume now that you have been asked to forecast cash flows that you will have available to repurchase stock and pay dividends during the next 5 years for Conrail (from problem). In making these forecasts, you can assume the following -

• Net Income is anticipated to grow 10% a year from 1995 levels for the next 5 years

• Capital expenditures and depreciation are expected to grow 8% a year from 1995 levels

• The revenues in 1995 were $ 3.75 billion, and are expected to grow 5% each year for the next 5 years. The working capital as a percent of revenues is expected to remain at 1995 levels

• The proportion of net capital expenditures and depreciation that will be financed with debt will drop to 30%

a. Estimate how much cash Conrail will have available to pay dividends or repurchase stocks over the next 5 years.

b. How will the perceived uncertainty associated with these cash flows affect your decision on dividends and equity repurchases?

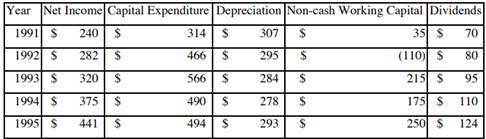

Problem: You are analyzing the dividend policy of Conrail, a major railroad, and you have collected the following information from the last 5 years -

The average debt ratio during this period was 40% and the total non-cash working capital at the end of 1990 was $ 10 million.

a. Estimate how much Conrail could have paid in dividends during this period.

b. If the average return on equity during the period was 13.5%, and Conrail had a beta of 1.25, what conclusions would you draw about Conrail's dividend policy? (The average T.Bond rate during the period was 7%, and the average return on the market was 12.5% during the period)