Reference no: EM13171908

Objective: Employee stock option accounting at Starbucks Corporation

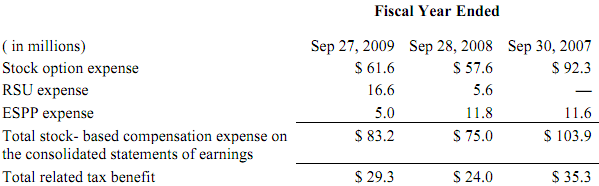

Starbucks Corp., the passionate purveyors of coffee and everything else that goes with a full and rewarding coffeehouse experience, included the following table in its 2009 annual report:

Total stock based compensation and ESPP expense recognized in the consolidated financial statements

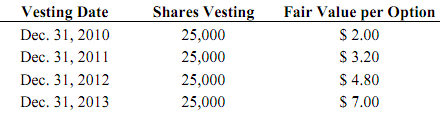

Starbucks maintains several share- based compensation plans that permit the company to grant employee stock options, restricted stock, and restricted stock "units" or RSUs. Starbucks also has an employee stock purchase plan ("ESPP") that allows participating employees to buy shares at a discounted price. At some companies, the discount can be as much as 15% lower than the prevailing market price. Stock options to purchase Starbucks' common shares are granted at an exercise price equal to the market price of the stock on the date of grant. Most options become exercisable in four equal installments beginning one year from the date of the grant and expire 10 years from the date of grant. Suppose Starbucks issues 100,000 employee stock options on January 1, 2010, and that one-fourth of the options vest in each of the next four years, beginning on December 31, 2010. For financial reporting purposes, the company elects to separate the total award into four groups (or tranches) according to the year in which each vests. Starbucks then measures the compensation cost for each vesting date tranche as if it was a separate award. The following table provides details about each vesting tranche:

Requirements

Prepare a letter to the President of Starbucks to answer the following questions.

1. Each tranche has the same exercise price- the market price of the stock on the grant date, or $ 23 on January 1, 2010. Explain why the option fair value increases with the vesting date.

2. Consider only the first option tranche vesting on December 31, 2010, and suppose that the price of Starbucks' common stock is $ 40 on that date. Determine the compensation expense that Starbucks would record in 2010 for this first option tranche. No stock options are exercised by employees that year.

3. Suppose that the price of Starbucks' common stock falls to $ 35 as of December 31, 2011. Considering only the first two option tranches, determine the compensation expense that Starbucks would record in 2011. No stock options are exercised by employees that year.

4. At the beginning of 2012, employees exercise 10,000 of the 2010 options. Employees hand over the 10,000 options along with $ 23 per option- the exercise price- and receive from the company an equal number of shares. The price of Starbucks' common stock is $ 35 per share on the exercise date. Prepare the journal entry Starbucks will use to record this transaction.

5. In 2009, Starbucks' shareholders approved a management proposal to allow for a one-time stock option exchange program, designed to provide employees an opportunity to exchange certain outstanding but underwater stock options for a lesser amount of new options granted with lower exercise prices. Under this proposal, employees could exchange options granted with an exercise price greater than $ 19 and receive new options with an exercise price of about $ 15. A total of 14.3 million stock options were tendered by employees and 4.7 million of new stock options were granted. According to the company's financial statement note: "No incremental stock option expense was recognized for the exchange because the fair value of the new options, using standard employee stock option valuation techniques, was approximately equal to the fair value of the surrendered options they replaced." Explain why a company might offer employees the opportunity to exchange underwater stock options for new options with a lower exercise price?

6. Explain how management determined that only 4.7 million of new options would be granted in exchange for the 14.3 million options tendered. In other words, why might management be reluctant to grant 10.0 million of the new options?

|

Find the temperature of the coffee after the ice melts

: The heat of fusion of ice (the heat associated with ice melting) is 6.0 kJ/mol. Find the temperature of the coffee after the ice melts.

|

|

How many grams of product aluminum chloride can be produced

: if 25g of aluminum are allowed to react with 50.g of hydrochloric acid, how many grams of the product, aluminum chloride can be produced? equation.

|

|

State a sample of nitrogen gas had a volume

: A sample of nitrogen gas had a volume of 500. mL, a pressure in its closed container of 740.0 torr and a temperature of 25.0°C.

|

|

State what distance is needed to decrease the intensity

: If a radiation source has an intensity of 700 rem at 2.00m, what distance is needed to decrease the intensity of exposure to below 25 rem

|

|

Employee stock option accounting at starbucks corporation

: Explain how management determined that only 4.7 million of new options would be granted in exchange for the 14.3 million options tendered. In other words, why might management be reluctant to grant 10.0 million of the new options?

|

|

What additional experiment would you perform

: When 2-propanol was used as the developing solvent, two substances moved with the solvent front (Rf = 1) during TLC analysis on a silica gel plate. Can you conclude that they are identical? If not, what additional experiment would you perform?

|

|

Which one of the following is a buffer solution

: Which one of the following is a buffer solution?

|

|

What is the new volume of gas in liters

: A sample containing 2.20 moles of neon gas has a volume of 8.00 L. Assume that the pressure and the temperature remain constant. What is the new volume of gas in liters when a sample of 70.0 g neon is added to the neon gas already in the container..

|

|

State starting with any alkane alkene or alkyne

: starting with any alkane, alkene, or alkyne as your only organic reactant, propose a series of chemical reactions that will yield

|