Reference no: EM131301050

WACC Puzzle: Price or Value?

The Set up

In the utopian world, maximizing a company's stock price is equivalent to maximizing it's value, since markets are efficient. But what if they are not? What if markets are driven by short term considerations and investors? In that case, maximizing prices is not the same as maximizing value.

Price versus Value

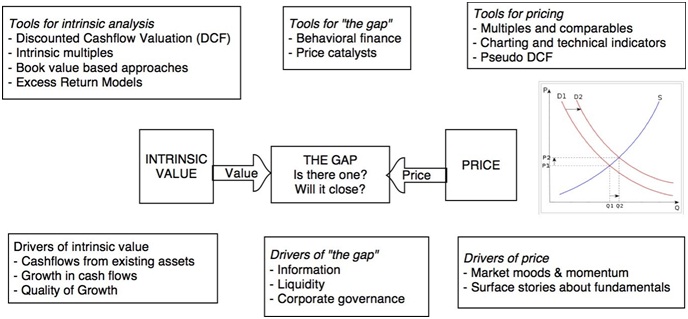

To understand the contrast between price and value, think of the two processes separately. The value process is driven by a company's capacity to generate and grow cash flows in the long term and the risk in these cash flows. In that process, it is fundamentals that drive value up and down. The pricing process is one of demand and supply, with everything that affects demand and supply causing prices to move up and down. In particular, mood and momentum (which are not fundamentals) can cause prices to move even when value does not. Here is a picture of how I see the contrast:

The friction between the two is at the heart of every investment philosophy. A trader, for instance, is a pure pricing animal, focused on buying at a low price and selling at a high one. Not surprisingly, the tools of a trader are designed to capture momentum shifts and may very include not only multiples/comparables but charts. A pure value investor buys for the fundamentals and is not swayed by market movements to the contrary, though to make price appreciation, the price has to adjust to value. A believer in efficient markets comes to the conclusion that while price and value can be different, the differences are random and that looking for them is a waste of time and money.

Laurence Fink's Advice to Companies

In this interview, Laurence Fink who heads Blackstone, the largest institutional investor in the world, argues that firms should focus less on prices and more on value. He uses earnings reports as his lever, arguing, in this letter to S&P 500 corporations, that companies should be more focused on delivering on long term value drivers and not on beating earnings expectations by a cent or two. Mr. Fink has said some stupid things in the past but this letter actually contains grains of truth, though layered with lots of hypocrisy and double talk. This advice is neither unusual nor novel. In fact, Mike Jensen, a key founder of the efficient market school, wrote a much more pointed article arguing that companies should sometimes dare to keep their stock prices low, in order to go for higher value. In fact, Mr. Fink is part of trio of heavyweights, the others being Jamie Dimon, CEO of JP Morgan Chase and Warren Buffett, value investing icon, who are pushing for long-termism at US companies and are supposedly looking at proposals to make it happen.

Questions/ discussion issues

1. Do you think that investors are collectively guilty of being short term in their thinking? What evidence can you offer to back this up?

2. If yes, who do you think is more short term? Institutional investors or individual investors? Any evidence?

3. Are managers at companies more long term or more short term than investors? Why?

4. Mr. Fink is suggesting that if companies don't tell compelling stories about where they are going, investors will step in and fill in the details. Do you agree with this statement? If yes, what is the solution?

5. If your end game is a more efficient market (where value and price converge), and you were a top public policy official or a politicians running for high office, what changes would you propose to market regulations, tax laws and investor rights to make this happen?