Reference no: EM13334930

You are employed as a management accountant within JH Alarms plc. The company began in the South of England 19 years ago with the entrepreneurial intuition of John Harris. He began the business by contracting to change fire alarms in large stocks of social housing. After several years of working in such a manner he began to acquire the alarms himself, from a Far Eastern supplier, prior to fitting them. This business expanded rapidly over the years, eventually becoming nationwide, and after recourse to the financial markets for debt and equity finance the company began to manufacture its own fire and burglar alarms within a modern factory environment in the UK. John Harris, now the Chairman and CEO, and his family still own 15% of the share capital of the business.

To a certain extent, although a plc, John Harris still runs the company as a personal fiefdom. He realises that constant innovation is vital within the burglar alarm market, in particular, and as a result has pushed through ever growing levels of debt financing.

However, there is an uneasy feeling among several senior managers and although they are reluctant to challenge John Harris, directly,(although a couple have recently resigned) they feel that the company is growing out of control and they are concerned with the share price performance in particular.

Task 1

You are approached by your manager, Mike Seenitall, who says, "I have recently been on a two day workshop concerning corporate performance management and it As part of your initial research you come across some research by Gosselin (2005) who, when undertaking a study of Canadian manufacturing firms stated that, "The results show that manufacturing firms continue to use financial performance measures. Despite the recommendations from experts and academics, the firms that implement a balanced scorecard or integrated [multidimensional] performance measurement system is low (p419)"

You are required to prepare a report for Mike Seenitall which considers:

I. The problematic issue of an over-reliance on financial performance management.

II. The possible benefits that JH Alarms may be forsaking by not utilising some type of integrated (multidimensional) scorecard for performance management.

Task 2

Whilst completing the above work Mike Seenitall approaches you with another problem and says, "It may be worse than I expected, profitability has fallen to such an extent over the last three years that I am beginning to wonder if the company will survive. The market seems to reflect this as the share price also seems to be suffering at the moment."

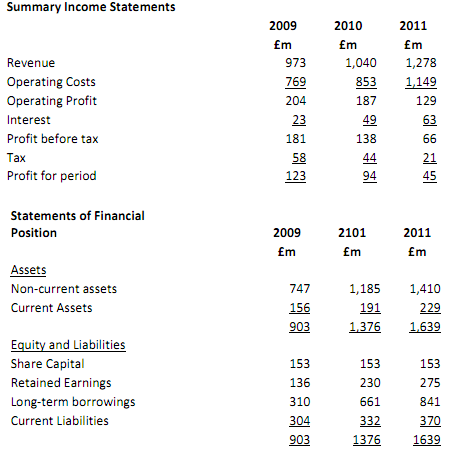

As you are completing an MBA you are aware of models that can be used to predict corporate failure and as a result gather the following information:

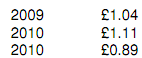

The average share price over the last three accounting years has been as follows:

There are 450 million shares in issue.

A relevant Z-score model for the industry sector is

- Z = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + X5 where:

- X1 = working capital/total assets

- X2 = accumulated retained earnings/total assets

- X3 = earnings before interest and tax/total assets

- X4 = market value of equity/ total long-term debt

- X5= revenue/total Assets

In turn, you decide to apply the following parameters for analysing your calculations:

♦ Companies with a ‘Z' score of below 1.81 are in danger and possibly heading towards bankruptcy within the next 2 years

♦ Companies with a score of 3 or above are financially sound

♦ Companies with scores between 1.81 and 2.99 need further investigation.

Required:

I. Comment upon the financial position of JH Alarms plc in the light of the last three years' performance. You should calculate Z-scores and use any additional financial ratios that you consider to be relevant.

II. Provide a brief summary of additional information which you would require in order to enable a more in depth analysis of the performance of the company.

III. Altman's (1968) Z-score model could be said to be an example of quantitative analysis, whereas Argenti's (1983) failure model could be described as qualitative.

You are required to discuss the relative strengths of these different approaches to the prediction of corporate failure (15 marks). You should also highlight the qualitative issues that may impact on the performance of JH Alarms plc and provide an indication as to why the identified factors are important.

|

Find the initial height of the ball

: a thin rod, of length L = 1.9m and negligible mass, that can pivot about one end to rotate in a vertical circle. A heavy ball is attached to the other end. find the initial height of the ball

|

|

Determine what is the profitability index of the investment

: You are offered an investment with returns of $ 2,440 in year 1, $ 3,767 in year 2, and $ 3,170 in year 3. The investment will cost you $ 5,422 today. If the appropriate Cost of Capital (quoted interest rate) is 6.6%,

|

|

List npv of higher npv project of computer safeguard systems

: Virus Stopper Inc., a supplier of computer safeguard systems, uses a cost of capital of 10 percent to evaluate average-risk projects, and it adds or subtracts 2 percentage points to evaluate projects of more or less risk

|

|

Evaluate two key changes in the selected company

: 1. Evaluate two (2) key changes in the selected company's management style from the company's inception to the current day. Indicate whether or not you believe the company is properly managed today. Provide support for your position.

|

|

Depth analysis of the performance of the company

: Provide a brief summary of additional information which you would require in order to enable a more in depth analysis of the performance of the company and comment upon the financial position of JH Alarms plc in the light of the last three years' ..

|

|

Compute the grams of so2 gas at stp

: Calculate the grams of SO2 gas present at STP in a 5.9 L container. A) 0.24 g B) 0.26 g C) 15 g D) 17 g E) 64 g

|

|

Determine what are operating cash flows in the first year

: The Old machine originally cost $ 363 and was bought Three (3) years ago (i.e. it has depreciated for three years). It could be sold today for $ 78 or sold in two years for $ 26 . The New machine would cost $ 467 and could be sold in two years for..

|

|

Is internet pose threats to traditional client server system

: Hures is a leading human resource service provider. To keep up with growing business demands,it implemented its first information system in 1987 purchasing a main frame computer that servedso-called dumb terminals on the users' desktops.

|

|

Distinguish between organizational needs assessment

: • Distinguish between organizational needs assessment and strategic planning, and assess how each can be helpful to identify the needs of an organization.

|