Reference no: EM13498398

Question

Caroline is a 55-year-old Australian resident. She is the chief marketing officer based in Sydney for XYZ Limited (XYZ), a public company listed on the Australian Securities Exchange (ASX). During the financial year ended 30 June 2012, she had the following transactions:

1. On 1 March 2012, Caroline received a $100,000 lump sum compensation payment for an injury she suffered to her neck in a car accident at the end of 2011.

2. Caroline put the entire $100,000 into a 90-day term deposit maturing on 30 June 2012, with an interest of $1,258 payable on maturity. At maturity, Caroline instructed the bank to reinvest both the interest and the principal into a term deposit with the same terms.

3. On 31 December 2011, she received a $30,000 dividend, franked to 50%.

4. She received $300,000 salary from XYZ.

5. She took out a loan of $25,000 and used the entire amount to make a contribution into her complying self-managed superannuation fund. On 30 June 2012, she pre-paid interest of $3,000 (for 10 months) on the loan.

6. On 30 June 2012, Caroline received $800,000 for the sale of a property which she inherited from her deceased mother. The property was her mother's main residence up until her mother's death on 14 July 2010. The market value of the property at the time of her mother's death was $750,000. The property was originally purchased for $320,000 in January 1991 and has not been used to produce assessable income.

7. Prior to her role at XYZ, Caroline was made redundant on 1 July 2011 from her position at Technology Limited, where she had been employed since 4 April 2007. On 30 July 2011 she was paid a genuine redundancy sum of $20,000. The payment is considered reasonable and she did not have any unused long service leave or annual leave.

REQUIRED:

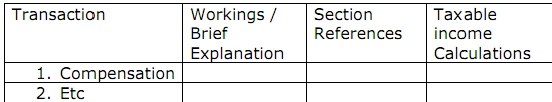

Calculate Caroline's taxable income for the year ended 30 June 2012. Show workings where relevant and briefly explain all inclusions and exclusions. Cite the relevant section reference(s). Set out your answer using the following table format:

|

Explain the rabbit brain tissue was homogenized

: Scientists are working on purifying PFK-1C from rabbit brain tissue. The rabbit brain tissue was homogenized and centrifuged to remove insoluble material. Next, the soluble preparation was loaded on top of an ATP-Sepharose column.

|

|

Compute the position of the image

: An object 0.680cm tall is placed 18.5cm to the left of the vertex of a convex spherical mirror having a radius of curvature of 25.0cm. Calculate the position of the image

|

|

Evaluate the average speed of car

: Imagine that you took a road trip. Based on the information in the table, what was the average speed of your car

|

|

Calculate the assessable - deductible amount

: Necktie Pty Ltd (Necktie), an Australian resident company, had the following transactions in the year ended 30 June 2012.

|

|

Define taxation law

: Calculate Caroline's taxable income for the year ended 30 June 2012. Show workings where relevant and briefly explain all inclusions and exclusions.

|

|

Describe three examples of how isoquants

: 1)Describe three examples of how isoquants and isocosts are used in industry. How would this vary when applying these to services?

|

|

Define the initial concentration of hypochlorite

: Given that the initial concentration of hypochlorite (ClO-) was 7.5x 10-4M, and the concentration at 200 seconds was determined to be 2.8 x 10-4M.

|

|

Find the focal length of the diverging lens

: A lighted candle is placed 36 cm in front of a diverging lens. The light passes through the diverging lens and on to a converging lens of focal length 10 cm that is 5 cm from the diverging lens. Find the focal length of the diverging lens

|

|

Evaluate the fraction of vocs in the exhaust

: Assume that gasoline is burned with 99% efficiency in a car engine, with 1% remaining unburned in the exhaust gases as VOCs. If the engine exhausts 16 kg of gases (MW = 30) for each kg of gasoline (MW = 100), calculate the fraction of VOCs in the ..

|