Reference no: EM132088274

Project Assignment -

Q1. Let Bt(T) be the cost at time t of a zero coupon bond with maturity T (in years). Assume B0(1) and B0(2) are known at time 0 but B1(2) will not be known until time 1.

(a) Prove or disprove B0(1)B1(2) = B0(2) under the absence of arbitrage.

(b) Show that if we know with certainty that m ≤ B1(2) ≤ M, then we can conclude mB0(1) ≤ B0(2) ≤ MB0(1).

Q2. The purpose of this question is to compute the price of an Up-and-Out Put option. An Up-and-Out Put option (UOP for short) with strike K and barrier level H has the same payoff at time T as a European put option: (K - ST)+, unless the stock went above the barrier level H during the life of the option, in which case, the holder receives nothing.

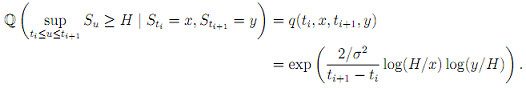

(a) In this question will use the following explicit formula for the probability of crossing the barrier:

This question uses this formula to improve the estimators in parts (c) and (d). A new estimator for the price is:

C~N_MC = e-rT 1/NMC k=1∑N_MC (K - ST(k)) + (1 - q(0, S0, T, ST(k))).

Show that this estimator is unbiased. Give an estimate of the UOP option with a 95% confidence interval. Is it different from the estimate in part (c)?

(b) Construct an estimator for the UOP option with rebate which is better. Are we overestimating or underestimating the price of the option?

Q3. Price an Asian call option with payoff (S- - K)+, with the mean S- = i=1∑n SiΔt/n computed over n dates spaced Δt = T/n time units apart. Assume

dSt = rStdt + √Vt StdWt(1)

dVt = ξVtdWt(2),

where Wt(1) and Wt(2) are standard Brownian motions with E[dWt(1)dWt(2)] = ρdt. Take r = 0.05, S0 = 50, T = 1, K = 50, √V0 = 0.3, ρ = 0.5 and n = 32.

(a) Apply variance reduction technique to improve your answer in part (a). Reconstruct Table 5.4 in "Asymptotically optimal importance sampling and stratification for pricing path-dependent options" by Glasserman, Heidelberger, Shahabuddin, Mathematical Finance, 9 (2), 117-152, 1999, with the last three column replaced by the variance ratio (Variance by your method=Variance by standard Monte Carlo).

|

Discuss the different types of variables you will find

: MGT305: Give an example of a business problem that would require research, and explain how it would be applied.

|

|

Determine the amounts necessary to record income taxes

: Determine the amounts necessary to record income taxes for 2016 and prepare the appropriate journal entry. (If no entry is required for a transaction/event.

|

|

Calculate settles inc margin and net income

: For the year ended December 31, 2016, Settles, Inc., earned an ROI of 10.4%. Sales for the year were $15 million, and average asset turnover was 2.6.

|

|

Every manager has different skills-specialties of expertise

: Every manager has different skills, and specialties of expertise. describe when you would authorize that loan,

|

|

Compute the price of an Up-and-Out Put option

: STATS 237 Project Assignment - The purpose of this question is to compute the price of an Up-and-Out Put option

|

|

Name an artist who has demonstrated positive responses

: If you were a creative artist, how would you balance your creative output with your need to make money through sales?

|

|

Determine what is the break-even point in units

: XYZ had sales of $19,500 (150 units at $130 per). manufacturing costs consisted of direct labor $2,550, direct materials $2,475, variable factor overhead.

|

|

What features are most appealing to your target

: How and when will your target use the product? What features are most appealing to your target? What media does your target turn to for information?

|

|

What limits should there be on insider trading

: Think about: what limits should there be on insider trading? In the USA, Pete Rose was a popular baseball player, and then manager,

|