Reference no: EM131118935

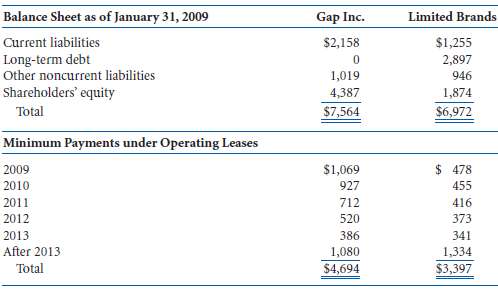

Some retailing companies own their own stores or acquire their premises under capital leases. Other retailing companies acquire the use of store facilities under operating leases, contracting to make future payments. An analyst comparing the capital structure risks of retailing companies may want to adjust reported financial statement data to put all firms on a comparable basis. Certain data from the financial statements of Gap Inc. and Limited Brands follow (amounts in millions).

Required

a. Compute the present value of operating lease obligations using an 8 percent discount rate for Gap Inc. and Limited Brands as of January 31, 2009. Assume that all cash flows occur at the end of each year. Also assume that the minimum lease payment each year after 2013 equals $360 million per year for three years for Gap Inc. and $333.5 million for four years for Limited Brands. (This payment scheduling assumption can be obtained by assuming that the payment amount for 2013 continues until the aggregate payments after 2013 have been made, rounding the number of years upward, and then assuming level payments for that number of years. For Gap Inc.: $1,080/$386 = 2.8 years. Rounding up to three years creates a three-year annuity of $1,080/3 years = $360 million per year.)

b. Compute each of the following ratios for Gap, Inc. and Limited Brands as of January 31, 2009, using the amounts originally reported in their balance sheets for the year.

(1) Liabilities to Assets Ratio = Total Liabilities/Total Assets

(2) Long-Term Debt to Long-Term Capital Ratio = Long-Term Debt/(Long-Term Debt + Shareholders' Equity)

c. Repeat Part b but assume that these firms capitalize operating leases.

d. Comment on the results from Parts b andc.

|

Examine the culture of the selected organization

: Imagine that there is a decline in the demand of product(s) or services supplied by the selected organization. Determine what the change in culture would need to be in response to this situation.

|

|

Prepare the retained earnings statement for 2010

: Accounting Change Presented are income statements prepared on a LIFO and FIFO basis for Carlton Company, which started operations on January 1, 2009.

|

|

Self-disclosure on social networking websites

: Summarize different models of self-disclosure and their uses in interpersonal communication to strengthen, distance, or manage relationships.

|

|

Create a job description and specifications for your dream

: Rationalize your performance appraisal program. Be sure to indicate the research and considerations that went into the design of the performance appraisal program

|

|

Compute the present value of operating lease obligations

: Compute the present value of operating lease obligations using an 8 percent discount rate for Gap Inc. and Limited Brands as of January 31, 2009. Assume that all cash flows occur at the end of each year. Also assume that the minimum lease payment eac..

|

|

Certain utensils used when eating

: Select one of the norms discussed in class. Example: way people stand in elevators, distance kept when two people are talking or sitting (invading personal space), certain utensils used when eating. Then go and observe the normal behavior which ..

|

|

Written just corrections on my current code

: Can someone please adjuct my code so when it compiles it does exactly what the assignment is asking. I dont need a whole new code written just CORRECTIONS on my current code that is attached

|

|

Bike uncomfortable and bike broken during operation

: Jim Corner, owner of Corner Bike Rentals, wants to start analyzing his company's quality. For each bike rental, there are four types of customer complaints: (1) bike not working properly, (2) wrong bike size, (3) bike uncomfortable, and (4) bike brok..

|

|

What is the net income reported by linden in the 2011

: What is the net income reported by Linden in the 2011 income statement if it prepares comparative financial statements starting with 2009?

|