Reference no: EM131750125

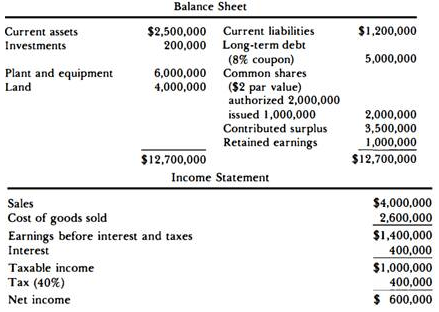

Question: The following financial statements of Depliant Industries were released for the year just ended:

Shares have generally traded at 7 times earnings.

Depliant's vice-president, Kay Smith, would like to pursue new investment opportunities that would require additional capital of $4,000,000. She believes that, if the new investments are undertaken, earnings before interest and taxes would grow at a rate of 8 percent per year for 5 years, and that the priceearnings ratio for Depliant's shares would immediately adjust upward to 10. Preliminary indications are that a straight-debt issue could be floated at 14-percent interest, debt with warrants at 12-percent interest, and convertible debt at 11-percent interest. New common shares could be sold to net $4 per share. If the debt with warrants were issued, each $ 1,000 debenture would carry 100 warrants, and each warrant would entitle the holder to purchase one share at an exercise price of $4.75 during the next 4 years. Under convertible debt, the conversion price would also be set at $4.75.

(a) Compute the present market price of Depliant's shares.

(b) Given the above projections, show the effects on earnings per share and share price at the end of the coming year, and also at the end of year 4, if the $4,000,000 are raised by

(i) straight debt,

(ii) common shares,

(iii) debt with warrants, and

(iv) convertible debt.

Assume that investors base their valuation of Depliant's shares on fully diluted earnings per share.

(c) Assume that all earnings for the 4 years will be paid out in dividends, and that any increase in capital will go 60 percent to plant and equipment and 40 percent to land. Show the balance sheet as it would appear at the end of year 4 assuming

(i) issuance of straight debt,

(ii) issuance of common shares,

(iii) issuance of debt with warrants, with all warrants exercised prior to expiry, and

(iv) issuance of convertible debt, not yet converted.