Reference no: EM131426982

Compute the net present value of the mold in Example 13.4, assuming that the debt capacity of the project is zero.

Example 13.4

Using the APV Method with the Certainty Equivalent Method

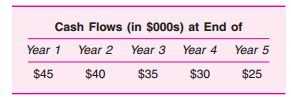

Emruss Ltd. is considering the purchase of a mold to make a new, improved dish drainer. The mold costs $150,000 and lasts five years, after which it has zero salvage value. Analysts estimate the expected unlevered cash flows to be $50,000 per year for the next five years and zero thereafter. The certainty equivalent cash flows, which tend to decline with the horizon when the expected cash flows are constant, are given in the table below:

The mold adds $100,000 to the firm's debt capacity in years 1 and 2, $50,000 in years 3 and 4, and zero in year 5. If Emruss has a borrowing rate of 6 percent and a tax rate of 50 percent, and will use its tax shields with certainty, what is the NPV of this investment if the risk-free rate is 5 percent?

|

Potential for the future of the us health care system

: Discuss the connection and evolution between the past and the potential for the future of the US Health Care System. How has the societal changes from an Agrarian (Farming) to Industrial to Service and Information Societies enabled changes to the US ..

|

|

Which of the following is not true about the piano

: In ancient times, story tellers were considered to be of lowly status.The symphony orchestra evolved because composers needed more musicians to play in order to be loud enough to be heard by public audiences in large spaces.

|

|

Compute the net present value of the mold

: The mold adds $100,000 to the firm's debt capacity in years 1 and 2, $50,000 in years 3 and 4, and zero in year 5. If Emruss has a borrowing rate of 6 percent and a tax rate of 50 percent, and will use its tax shields with certainty, what is the N..

|

|

Explain how the psychological contract can be integrated

: Explain how the psychological contract can be integrated in Skyline Internationalconsidering the significant amount of negative feedback from staff being faced by the organisation?

|

|

Compute the net present value of the mold

: The mold adds $100,000 to the firm's debt capacity in years 1 and 2, $50,000 in years 3 and 4, and zero in year 5. If Emruss has a borrowing rate of 6 percent and a tax rate of 50 percent, and will use its tax shields with certainty, what is the N..

|

|

Compute the effect of the adoption of this project

: Use the risk-neutral valuation method to directly show that the risk-neutral discounted value of the existing debt of Unitron is $636,000 higher if the project in Example 13.17 is adopted.

|

|

Explain what the last stage in the cps

: "Explain what the last stage in the CPS (Creative Problem Solving) Process (Control) means to you and how it ties back in to Stage 1 (Environmental Analysis).

|

|

Explain at least three challenges of succession planning

: Analyze at least three challenges of succession planning for your selected agency. Propose at least three components of effective implementation of succession planning.

|

|

The internet age from society and technological change

: As noted in this chapter, most smartphone owners use only a few apps for their phones. Are you one of them? Have you downloaded some apps only to later delete them? Why? Some of the most devoted designers and players of games have argued that game pl..

|