Reference no: EM13203904

Herbicide Ltd manufactures insecticide which is marketed in one and two litre bottles. The existing machinery owned by the company for the bottling of its product has now reached the end of its useful life, and the management of the company is deciding what equipment should be purchased to replace it. It is not necessary to replace the ancillary machinery which includes conveyor belts, washing and inspection machinery and other equipment.

Machines Under Consideration

The new bottle filling and capping machines being considered are:

1. The 'Bottle-Snap'.

2. The 'Seal'.

3. The 'Zip Cap'.

4. The 'Screw-Top'.

The 'Bottle-Snap' is an improved version of the existing equipment to be retired. This machine has a nominal capacity of 370 bottles per minute (bpm) for one litre bottles, or 125 bpm for two litre bottles.

The 'Seal' is a similar machine to the above, except that it has a much larger capacity. Its nominal capacity is 600 one litre bpm or 280 two litre bpm.

The 'Zip-Cap' uses tear-off caps and operates at a maximum (nominal) rate of 350 one litre bpm. This machine could be used to fill and seal two litre bottles, but with a greatly reduced production rate.

The 'Screw-Top' can be used to reseal bottles after the initial opening. The nominal capacity of this machine is 200 two litre bpm. This machine could be used to fill and seal one litre bottles.

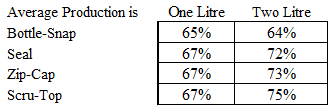

Departmental managers have determined the following average production capacities based on the preceding nominal (maximum) capacities of each machine.

Marketing Considerations

Management considers that either the 'Crown' or 'Zip-Cap' could be used for sealing the one litre bottles. 'Screw-Tops' are believed to be uneconomical for small bottles. Either 'Crown' or Screw-Top's' are considered suitable for the two litre bottles. Zip-Caps are thought to be unsuitable for two litre bottles.

The demand for pesticides is very seasonal and sales are highest during the summer months. Because of the large amount of storage space required in relation to value, it is uneconomical to build up large stocks during the cooler months for sale during periods of peak demand. It is therefore necessary to employ labour at penalty rates for evening and weekend shift work during periods of peak demand.

Sales

The present annual sales volume of the company is approximately 1,600,000 24-bottle crates of one litre bottles, and 1,400,000 12-bottle crates of two litre bottles.

The current selling price per crate for the company's insecticides is as follows:

- $1.20 per 24-bottle crate of one litre bottles

- $1.60 per 12-bottle crate of two litre bottles

The additional costs involved in the production of two litre 'Screw-Top' bottles would require a selling price of $1.75 per 12-bottle crate if this type of bottle were to be marketed.

Conventional or New Seals

The final choice has been narrowed down to five alternative proposals which are set out in Exhibit 1.

EXHIBIT 1

Identification of Alternatives

The four types of equipment being considered could be combined in five different ways to achieve the desired production capacities.

ALTERNATIVE A

This alternative would involve the acquisition of two 'Bottle-Snap' machines, one to be used to fill and seal one litre bottles and the used to fill and seal two litre bottles. The use of two such machines has the advantage of flexibility (the one litre machine could be modified to produce two litre bottles and vice versa).

ALTERNATIVE B

One 'Seal' could be used to produce both one litre and two litre bottles. A change in the size of bottles processed, however, requires an extensive changeover of parts, taking approximately four hours. If this machine were installed, batch production and the holding of larger inventories of finished products would be required.

ALTERNATIVE C

A 'Zip-Cap' machine could be used for the production of one litre bottles, and a 'Bottle-Snap' for two litre bottles. The latter could be used to produce one litre bottles if required.

ALTERNATIVE D

The one litre bottles could be processed using a 'Bottle-Snap' while the two litre bottles could be produced with a 'Scru-Top'. The former could be used to produce two litre 'Seal' bottles if required.

ALTERNATIVE E

The final alternative is to produce one litre bottles using a 'Zip-Cap' and the two litre bottles using a 'Scru-Top'.

Financial and Operating Data

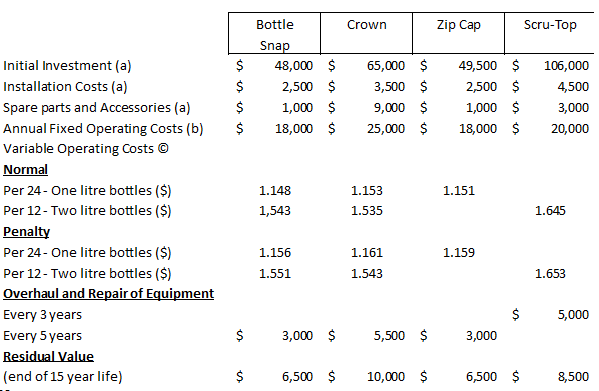

The Accountant for the company has prepared a schedule showing the initial costs of the alternative machines, together with expected operating costs and other relevant data. This information is reproduced in Exhibit 2.

EXHIBIT 2

Identification of Costs

Notes

a An initial investment allowance of 20 per cent is allowable for taxation purposes on the initial investment and installation costs.

Depreciation, at the rate of 20 per cent per annum (straight line), is allowable for tax purposes on all three items of expenditure required for acquisition, installation and parts inventory.

b. Annual fixed operating costs exclude depreciation.

c. Variable operating costs exclude taxation expenses. "Normal" variable operating costs per crate are those estimated for production at normal rates of pay. "Penalty" variable operating costs per crate are those estimated for production during periods when penalty rates of pay apply (late shifts and weekends)

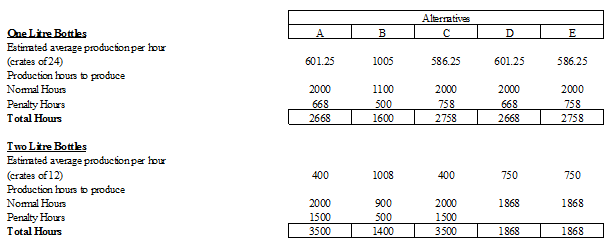

The Production Manager has prepared estimates of the total annual production hours required to meet expected sales for each of the five alternative proposals. These estimates are based on the expected average rate of production per hour, and separate 'normal' production hours from 'penalty' production hours. The Production Manager's estimates are reproduced in Exhibit 3.

EXHIBIT 3

Production Hour Estimates

The company uses the net present value method in its capital budgeting decisions. The after tax required rate of return is 10%. Income tax rates for simplicity are 50%. Assume that any taxation implications occur at the time of the relevant cash flow or in the case of depreciation, in the year of the depreciation claim. Assume also that all cash flows take place at the end of each period and that inflation is zero.

Required

1) Show the cash flows for each alternative proposal listed in Exhibit 1.

2) Compute the Net Present Value, Payback Period and the Internal Rates of Return for each alternative.

3) On the basis of your analysis in question 2, which of the alternatives would you recommend?