Reference no: EM132769768

Question 1

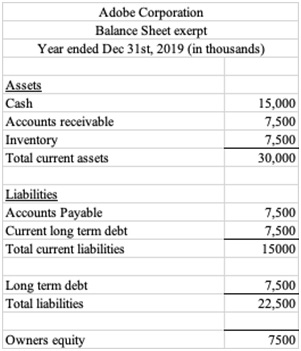

Adobe is a software company that creates the most innovative creativity apps. Recently their software has become cloud based. Their price to book ratio is 1.67 and they currently have 1,000,000 shares outstanding. Below you will find an excerpt from their balance sheet for 2019

a) Calculate the stock price using the price to book ratio.

b) If their stock price is listed on the stock market at $9, should the stockholders sell or hold the stock?

c) Critically discuss the price to book ratio in valuing stocks and provide an alternative method to see if a stock is undervalued or overvalued.

Question 2

Cornerstone Corporation is a large construction company in Boston, Massachusetts. Their income statement for last year indicated a net income of $12,500,000, and the corporation has 1,100,000 shares of common stock outstanding. The current stock price of Cornerstone Corporation on the Boston stock exchange is $13.75 per share. It is looking to expand its operation to the neighboring cities and will be issuing 400,000 extra shares and expects to have a net income of $16,000,000 by the end of the current year.

a) Assuming the company's price to earnings ratio remains at its current level, what will be the company's stock price one year from now?

b) The PE ratio is a very common method used by investors to get a quick calculation on the market's perception of a company. Evaluate the formula used to calculate the PE ratio focusing on the limitations of this method of valuation?

Question 3

Glencore is the largest mining corporation in the world with annual revenues of $220 billion dollars, their headquarters are located in the UK and Switzerland. In financing new mining locations, the corporation uses both debt and equity financing to provide a favorable balance between risk and cost of capital. Its financial partners will provide unlimited financing at an annual interest rate of 10% as long as its target capital structure is 25% debt, and 75% common equity. Last year the company paid a dividend of $2.25 per share and the constant growth rate is expected at 4.5%. The current price on the stock market is $14.7 per share. Their corporate tax rate is 32%. They are looking to invest in mining locations in two areas, one in South Africa, and the other in Australia. The rate of return for the two locations are expected to be 12% and 16% respectively. Assume that all of its potential projects are equally risky, and as risky as the firm's other assets.

a) Calculate Glencore's cost of common equity.

b) Calculate their Weighted Average Cost of Capital.

c) Critically evaluate how corporations use the weighted average cost of capital to decide on their future projects, and decide which location Glencore should invest in.

Part B: Answer all 3 of the following Questions

Question 4

Two common investment appraisal techniques used in corporate finance are the IRR, and the Payback method.

Critically discuss these appraisal techniques and discuss the advantages and disadvantages of each.

Question 5

Financial decisions of corporations are based on many techniques discussed in this course which are in turn based on their respective set of assumptions.

Critically discuss the Expected Net Present Value method (ENPV) and explain why it may be more effective than the NPV method in valuing projects?

Question 6

Corporate governance can be defined as the set of rules governing the way the directors interact both with each other in the effective management of the company, and with the shareholders in their accounting for their stewardship of the company.

Critically discuss key corporate governance issues.

|

What is your philosophy of management

: Your assessment should focus on your knowledge of management (work, experience, style, strengths, challenges, etc....). Also include the following.

|

|

Describe an instance in which you attempted to a break

: Describe an instance in which you attempted to either break a bad habit or an instance in which you attempted to begin a new behavior.

|

|

Calculate the current ratio for sanchez company

: Calculate the current ratio for Sanchez Company. Long-term Notes Payable 365,000. Accounts Receivable, net 450,000. Marketable Securities 175,000

|

|

Behavior arises from fundamental psychology

: We learned that the pattern of behavior arises from fundamental psychology and in particular.

|

|

Calculate the stock price using the price to book ratio

: Calculate the stock price using the price to book ratio and Critically discuss the price to book ratio in valuing stocks and provide an alternative method

|

|

Challenges face by government contract human service program

: Based on your readings for this week, in your initial post, discuss a traditional nonprofit governance board and the funding practices of the organization.

|

|

Calculate provision for warranty repairs and make journal

: Calculate the provision for warranty repairs and make journal entries. % goods sold Nature of defects Cost of repairs if items had defects

|

|

Develop a plan to gather data for a job analysis

: Review the material presented in the course about how to conduct a job analysis, the various methods for collecting data, and the pros and cons of the various.

|

|

Find which would be considered an investing activity

: Find which of the following would be considered an investing activity, In preparing a statement of cash flows? sale of merchandise on credit

|