Reference no: EM13213852

Question 1:

A 5-year bond with face value of $1000 makes annual coupon payments of $80 and is currently selling at par. Calculate the return you will earn if you buy the bond now and sell it at the end of the current year when bond is expected to have a yield to maturity of 6 per cent.

Question 2:

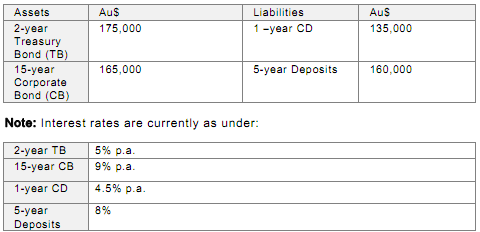

Table 1 is an excerpt of MM Bank's balance sheet. Use the balance sheet

information and the notes underneath to answer questions a through c.

Table 1: Excerpt of the balance sheet of MM Bank Limited.

Note: Interest rates are currently as under:

Assume that all instruments are currently selling at par (equal to book value) and that the frequency of interest payment is once a year for all instruments.

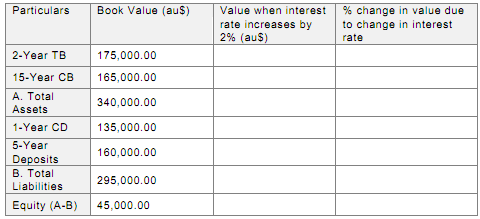

a. Fill Table 2 to show the impact on the Bank's equity of a 2% change in all interest rates. Provide working below the table.

Table 2: Impacts on equity for a 2% change in the interest rates.

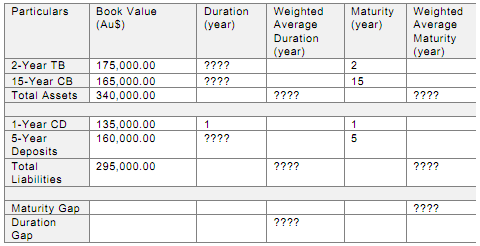

b. Calculate duration at the current rate of interest (see notes under Table 2.1) of each instrument, the weighted average duration of assets and liabilities, and the weighted average maturities of assets and liabilities, and the duration and maturity gaps. Insert your results in the marked (????) cells of Table 2.3. Show workings under the table.

Table 3: Maturity and Duration Gap

c. What do the gap estimates say about the Bank's exposure to the interest rate risk? What is the economic interpretation of the duration gap?

|

Explain and identify the type of interactions

: Identify the type of interactions involved in each of the following processes taking place during the dissolution of sodium chloride (NaCl) in water.

|

|

Explain the equation for the location of partile in the box

: In solution in 6EB in Atkins 9th edition is not clear to me. The equation for the location of partile in the box is different from the one that is in the book.

|

|

Explain no change in temperature and amount of gas

: What is the new pressure, in atm,when the air is placed in tanks that have the following volumes, if there is no change in temperature and amount of gas?

|

|

What is the hybridization of each carbon for structure

: What is the hybridization of each carbon for the following structure? Please explain each one and provide the line structure. Supposedly there should be two hybridized sp2 and two hybridized Sp3

|

|

Calculate the return you will earn

: A 5-year bond with face value of $1000 makes annual coupon payments of $80 and is currently selling at par. Calculate the return you will earn if you buy the bond now and sell it at the end of the current year when bond is expected to have a yield..

|

|

Describe what happens to the bank loans

: People hold $400 million of bank deposits but no currency. Banks have made $380 million dollars of loans and only hold enough reserves to satisfy reserve requirements. Because of uncertainty, banks choose to hold $10 million more in reserves.

|

|

Explain what must a woman''s average speed have been

: To qualify to run in the 2005 boston marathon, a distance of 26.2 mile, an 18 years old women had to have completed another marathon in 3 hours and 40 minutes or less. To qualify, what must a woman's average speed have been

|

|

How to calculate the exact discounted values involved

: Suppose that average earnings by age group for bachelor's and Master's degree holders were as follows: Age group bachelor's Master's 23-24 $35,000 -- 25-29 40,000 $48,000 30-34 44,000 56,000 Suppose further that tuition and fees for the Master's p..

|

|

Depict lewis structure of the lowest energy imidazolium ion

: Draw the Lewis structure of the lowest energy imidazolium ion. This is the lowest energy product formed when imidazole is protonated.

|