Reference no: EM131144578

6-1. Your brother wants to borrow $10,000 from you. He has offered to pay you back $12,000 in a year. If the cost of capital of this investment opportunity is 10%, what is its NPV? Should you undertake the investment opportunity? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged.

6-2. You are considering investing in a start-up company. The founder asked you for $200,000 today and you expect to get $1,000,000 in nine years. Given the riskiness of the investment opportunity, your cost of capital is 20%. What is the NPV of the investment opportunity? Should you undertake the investment opportunity? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged.

6-3. You are considering opening a new plant. The plant will cost $100 million upfront. After that, it is expected to produce profits of $30 million at the end of every year. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged.

6-4. Your firm is considering the launch of a new product, the XJ5. The upfront development cost is $10 million, and you expect to earn a cash flow of $3 million per year for the next five years. Plot the NPV profile for this project for discount rates ranging from 0% to 30%. For what range of discount rates is the project attractive?

6-5. Bill Clinton reportedly was paid $10 million to write his book My Way. The book took three years to write. In the time he spent writing, Clinton could have been paid to make speeches.Given his popularity, assume that he could earn $8 million per year (paid at the end of the year)speaking instead of writing. Assume his cost of capital is 10% per year.

a. What is the NPV of agreeing to write the book (ignoring any royalty payments)?

b. Assume that, once the book is finished, it is expected to generate royalties of $5 million in the first year (paid at the end of the year) and these royalties are expected to decrease at a rate of 30% per year in perpetuity. What is the NPV of the book with the royalty payments?

6-6. FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six years and the cost is $200,000 per year. Once in production, the bike is expected to make $300,000 per year for 10 years. Assume the cost of capital is 10%.

a. Calculate the NPV of this investment opportunity, assuming all cash flows occur at the end of each year. Should the company make the investment?

b. By how much must the cost of capital estimate deviate to change the decision? (Hint: Use Excel to calculate the IRR.)

c. What is the NPV of the investment if the cost of capital is 14%?

6-7. OpenSeas, Inc. is evaluating the purchase of a new cruise ship. The ship would cost $500 million, and would operate for 20 years. OpenSeas expects annual cash flows from operating the ship to be $70 million (at the end of each year) and its cost of capital is 12%.

a. Prepare an NPV profile of the purchase.

b. Estimate the IRR (to the nearest 1%) from the graph.

c. Is the purchase attractive based on these estimates?

d. How far off could OpenSeas' cost of capital be (to the nearest 1%) before your purchase decision would change?

6-8. You are considering an investment in a clothes distributor. The company needs $100,000 today and expects to repay you $120,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your cost of capital is 20%. What does the IRR rule say about whether you should invest?

6-9. You have been offered a very long term investment opportunity to increase your money one hundredfold. You can invest $1000 today and expect to receive $100,000 in 40 years. Your cost of capital for this (very risky) opportunity is 25%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree?

6-10. Does the IRR rule agree with the NPV rule in Problem 3? Explain.

6-11. How many IRRs are there in part (a) of Problem 5? Does the IRR rule give the right answer in this case? How many IRRs are there in part (b) of Problem 5? Does the IRR rule work in this

case?

6-12. Professor Wendy Smith has been offered the following deal: A law firm would like to retain her for an upfront payment of $50,000. In return, for the next year the firm would have access to 8 hours of her time every month. Smith's rate is $550 per hour and her opportunity cost of capital is 15% (EAR). What does the IRR rule advise regarding this opportunity? What about the NPV rule?

6-13. Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $5 million. The product is expected to generate profits of $1 million per year for 10 years. The company will have to provide product support expected to cost

$100,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year.

a. What is the NPV of this investment if the cost of capital is 6%? Should the firm undertake the project? Repeat the analysis for discount rates of 2% and 12%.

b. How many IRRs does this investment opportunity have?

c. Can the IRR rule be used to evaluate this investment? Explain.

6-14. You own a coal mining company and are considering opening a new mine. The mine itself will cost $120 million to open. If this money is spent immediately, the mine will generate $20 million for the next 10 years. After that, the coal will run out and the site must be cleaned and maintained at environmental standards. The cleaning and maintenance are expected to cost $2 million per year in perpetuity. What does the IRR rule say about whether you should accept this opportunity? If the cost of capital is 8%, what does the NPV rule say?

6-15. Your firm spends $500,000 per year in regular maintenance of its equipment. Due to the economic downturn, the firm considers forgoing these maintenance expenses for the next three years. If it does so, it expects it will need to spend $2 million in year 4 replacing failed equipment.

a. What is the IRR of the decision to forgo maintenance of the equipment?

b. Does the IRR rule work for this decision?

c. For what costs of capital is forgoing maintenance a good decision?

6-16. You are considering investing in a new gold mine in South Africa. Gold in South Africa is buried very deep, so the mine will require an initial investment of $250 million. Once this investment is made, the mine is expected to produce revenues of $30 million per year for the next 20 years. It will cost $10 million per year to operate the mine. After 20 years, the gold will be depleted. The mine must then be stabilized on an ongoing basis, which will cost $5 million per year in perpetuity. Calculate the IRR of this investment. (Hint: Plot the NPV as a function of the discount rate.)

6-17. Your firm has been hired to develop new software for the university's class registration system. Under the contract, you will receive $500,000 as an upfront payment. You expect the development costs to be $450,000 per year for the next three years. Once the new system is in place, you will receive a final payment of $900,000 from the university four years from now.

a. What are the IRRs of this opportunity?

b. If your cost of capital is 10%, is the opportunity attractive?

Suppose you are able to renegotiate the terms of the contract so that your final payment in year 4 will be $1 million.

c. What is the IRR of the opportunity now?

d. Is it attractive at these terms?

6-18. You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $100 million upfront. Once built, it will generate cash flows of $15 million at the end of every year over the life of the plant. The plant will be useless 20 years after its completion once the mine runs out of ore. At that point you expect to pay $200 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 12%,

a. What is the NPV of the project?

b. Is using the IRR rule reliable for this project? Explain.

c. What are the IRR's of this project?

6-19. You are a real estate agent thinking of placing a sign advertising your services at a local bus stop. The sign will cost $5000 and will be posted for one year. You expect that it will generate additional revenue of $500 per month. What is the payback period?

6-20. You are considering making a movie. The movie is expected to cost $10 million upfront and take a year to make. After that, it is expected to make $5 million when it is released in one year and $2 million per year for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10%?

6-21. You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $10 million. Investment A will generate $2 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.5 million at the end of the first year and its revenues will grow at 2% per year for every year after that.

a. Which investment has the higher IRR?

b. Which investment has the higher NPV when the cost of capital is 7%?

c. In this case, for what values of the cost of capital does picking the higher IRR give the correct answer as to which investment is the best opportunity?

6-22. You have just started your summer internship, and your boss asks you to review a recent analysis that was done to compare three alternative proposals to enhance the firm's manufacturing facility. You find that the prior analysis ranked the proposals according to their IRR, and recommended the highest IRR option, Proposal A. You are concerned and decide to redo the analysis using NPV to determine whether this recommendation was appropriate. But while you are confident the IRRs were computed correctly, it seems that some of the underlying data regarding the cash flows that were estimated for each proposal was not included in the report. For Proposal B, you cannot find information regarding the total initial investment that was required in year 0. And for Proposal C, you cannot find the data regarding additional salvage value that will be recovered in year 3. Here is the information you have:

Suppose the appropriate cost of capital for each alternative is 10%. Using this information, determine the NPV of each project. Which project should the firm choose?

Why is ranking the projects by their IRR not valid in this situation?

6-23. Use the incremental IRR rule to correctly choose between the investments in Problem 21 when the cost of capital is 7%. At what cost of capital would your decision change?

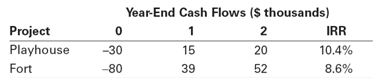

6-24. You work for an outdoor play structure manufacturing company and are trying to decide between two projects:

You can undertake only one project. If your cost of capital is 8%, use the incremental IRR rule to make the correct decision.

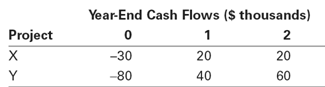

6-25. You are evaluating the following two projects:

Use the incremental IRR to determine the range of discount rates for which each project is optimal to undertake. Note that you should also include the range in which it does not make sense to take either project.

6-26. Consider two investment projects, which both require an upfront investment of $10 million, and both of which pay a constant positive amount each year for the next 10 years. Under what conditions can you rank these projects by comparing their IRRs?

6-27. You are considering a safe investment opportunity that requires a $1000 investment today, and will pay $500 two years from now and another $750 five years from now.

a. What is the IRR of this investment?

b. If you are choosing between this investment and putting your money in a safe bank account that pays an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR with the IRR of the investment? Explain

6-28. AOL is considering two proposals to overhaul its network infrastructure. They have received two bids. The first bid, from Huawei, will require a $20 million upfront investment and will generate $20 million in savings for AOL each year for the next three years. The second bid, from Cisco, requires a $100 million upfront investment and will generate $60 million in savings each year for the next three years.

a. What is the IRR for AOL associated with each bid?

b. If the cost of capital for this investment is 12%, what is the NPV for AOL of each bid? Suppose Cisco modifies its bid by offering a lease contract instead. Under the terms of the lease, AOL will pay $20 million upfront, and $35 million per year for the next three years. AOL's savings will be the same as with Cisco's original bid.

c. Including its savings, what are AOL's net cash flows under the lease contract? What is the IRR of the Cisco bid now?

d. Is this new bid a better deal for AOL than Cisco's original bid? Explain.

6-29. Natasha's Flowers, a local florist, purchases fresh flowers each day at the local flower market. The buyer has a budget of $1000 per day to spend. Different flowers have different profit margins, and also a maximum amount the shop can sell. Based on past experience, the shop has estimated the following NPV of purchasing each type:

What combination of flowers should the shop purchase each day?

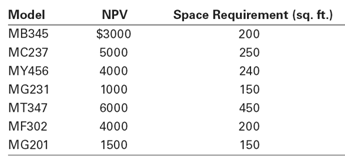

6-30. You own a car dealership and are trying to decide how to configure the showroom floor. The floor has 2000 square feet of usable space.You have hired an analyst and asked her to estimate the NPV of putting a particular model on the floor and how much space each model requires

In addition, the showroom also requires office space. The analyst has estimated that office space generates an NPV of $14 per square foot. What models should be displayed on the floor and how many square feet should be devoted to office space?

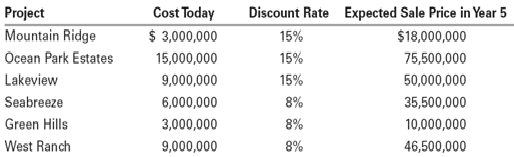

6-31. Kaimalino Properties (KP) is evaluating six real estate investments. Management plans to buy the properties today and sell them five years from today. The following table summarizes the initial cost and the expected sale price for each property, as well as the appropriate discount rate based on the risk of each venture.

KP has a total capital budget of $18,000,000 to invest in properties.

a. What is the IRR of each investment?

b. What is the NPV of each investment?

c. Given its budget of $18,000,000, which properties should KP choose?

d. Explain why the profitably index method could not be used if KP's budget were $12,000,000 instead. Which properties should KP choose in this case?

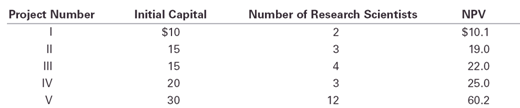

6-32. Orchid Biotech Company is evaluating several development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects. Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (all cost values are given in millions of dollars).

a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects?

b. Suppose in addition that Orchid currently has only 12 research scientists and does not anticipate being able to hire any more in the near future. How should Orchid prioritize these projects?

c. If instead, Orchid had 15 research scientists available, explain why the profitability index ranking cannot be used to prioritize projects. Which projects should it choose now?