Reference no: EM131622022

Question: Using job order costing and activity-based costing from Problems I and II, calculate the charge necessary to realize a 5-percent gain at the diagnostic center.

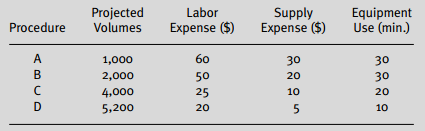

Problems I: ABC Diagnostic Center is developing an RVU and product cost for the following CT procedures, given the projected volumes and sample direct costs. Projected total costs for the CT department are $10,000,000 ($6,000,000 in direct costs and $4,000,000 in indirect costs). Calculate the cost per procedure using job order costing.

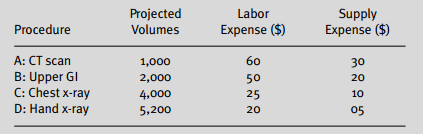

Problems II: ABC Diagnostic Center wants to develop a product cost for the following CT procedures using labor expense and supply expense to assign direct costs, and machine minutes as a cost driver to assign indirect costs. Projected total costs for the CT department are $10,000,000 ($6,000,000 in direct costs and $4,000,000 in indirect costs). Assign costs to each procedure using the following information.